The post Easy, safe, highly effective: Introducing Kraken Pockets appeared first on kitko.

]]>Your easy-to-use onchain gateway

Whether or not you’re a Kraken shopper or not, you should utilize multichain Kraken Pockets as your bridge to the decentralized monetary system. Constructed on our core values of privateness and safety, Kraken Pockets offers self-custody of digital property and information by offering an onchain expertise customers will love – backed by Kraken’s world-class safety and shopper service.

The gorgeous UX means that you can simply discover the onchain world; no community switching or manually creating a number of seed phrases. Kraken Pockets is the one-stop resolution in your self-custody wants:

- Complete portfolio monitoring: Monitor your tokens, NFTs and DeFi positions multi functional place

- Multichain help: Seamlessly work together with eight of the preferred blockchains: Bitcoin, Ethereum, Solana, Optimism, Base, Arbitrum, Polygon and Dogecoin

- WalletConnect integration: Securely entry hundreds of the newest and hottest dApps

- 24/7/365 help: Our award-winning buyer expertise group is all the time prepared to assist guarantee your onchain expertise is a good one

Privateness is paramount

Kraken Pockets collects absolutely the minimal quantity of knowledge required to operate as a pockets. Not even inner app efficiency analytics are collected.

Consumer exercise is proxied by Kraken’s personal infrastructure, shielding your IP tackle and stopping your identification and site info from potential exterior publicity.

The privateness of your private info is essential to us. We don’t maintain any Kraken Pockets consumer sign-in particulars, electronic mail addresses or KYC info.

Backed by Kraken’s industry-leading safety

Safeguarding your information and digital property is our primary goal. Kraken Pockets was in-built collaboration with the group that has secured Kraken trade’s property for over 12 years. It has a number of layers of safety defending your non-public keys: biometrics out of your cell gadget and user-provided password encryption.

However true to our Safety Above Every little thing mindset, we didn’t cease there.

We engaged Path of Bits to do a full-scale safety audit on our code to verify we weren’t lacking something. Since 2012, Path of Bits has helped safe a few of the world’s most focused organizations and units by combining high-end safety analysis with a real-world attacker mentality to cut back threat and fortify code.

Subsequent up: Open all of Kraken Pockets’s supply code to the world.

Kraken Pockets is the primary major-exchange pockets to be open-source at launch

Open supply improvement strengthens safety by making each line of code we deploy out there for third-party overview. Kraken Pockets’s code is out there on GitHub.

Why open supply? As a result of it’s on the coronary heart of what crypto is all about: transparency, decentralization and neighborhood. It’s why we now have an open-source grant program: to spotlight and elevate the good work that’s essential to serving to cryptocurrencies attain their potential.

Our work wouldn’t be potential with out the numerous hours spent on modern concepts by passionate open-source contributors. Bitcoin and different cryptocurrencies merely wouldn’t exist with out these heroes. Kraken will all the time help the open-source neighborhood and Kraken Pockets furthers this dedication.

The long run is onchain: Get began with Kraken Pockets

The journey with Kraken Pockets is simply starting – extra performance is to come back. Our mission to deliver the world onchain continues with a relentless dedication to our cypherpunk ideas. Keep tuned for extra improvements that embody the spirit of decentralization and empower your monetary freedom.

Welcome to the onchain future. Welcome to Kraken Pockets.

To study extra, take a look at our deep-dive technical weblog about How Kraken Pockets addresses challenges in cell crypto safety.

See the Kraken Pockets privateness discover for full disclosures.

These supplies are for common info functions solely and will not be funding recommendation or a suggestion or solicitation to purchase, promote, stake or maintain any cryptoasset or to have interaction in any particular buying and selling technique. Kraken doesn’t and won’t work to extend or lower the worth of any specific cryptoasset it makes out there. Some crypto merchandise and markets are unregulated, and also you might not be protected by authorities compensation and/or regulatory safety schemes. The unpredictable nature of the cryptoasset markets can result in lack of funds. Tax could also be payable on any return and/or on any enhance within the worth of your cryptoassets and it is best to search impartial recommendation in your taxation place. Geographic restrictions could apply.

The post Easy, safe, highly effective: Introducing Kraken Pockets appeared first on kitko.

]]>The post VeChain Value Poised For A Bullish Breakout? appeared first on kitko.

]]>Within the rollercoaster trip of the crypto market, VeChain (VET) has managed to maintain its head above water, showcasing resilience the place many others falter.

VeChain Analysts Take Discover

Crypto analysts are conserving tabs on VeChain, with some seeing a possible shiny future forward. Certain, there’s been discuss VeChain’s efficiency since 2021, and it’s had its share of tough patches. However of us like Crypto EA reckon that VeChain has been pushing by, increasing its community and staying within the sport regardless of the challenges.

Weathering The Storm

Regardless of the ups and downs of the market, VeChain’s present value stands at $0.039, with an honest buying and selling quantity of $124 million previously 24 hours and a market cap of $2.90 billion. Whereas it’s not skyrocketing, the truth that VeChain has seen a 1.50% enhance in value within the face of a downturn speaks volumes about its stability.

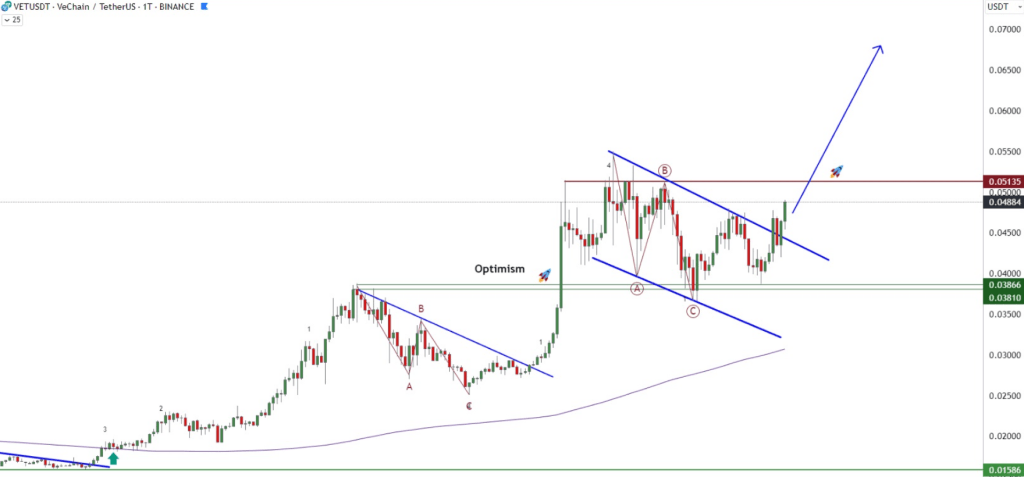

VET market cap at the moment at $2.8 billion. Chart: TradingView.com

Studying The Tea Leaves

One analyst, Ali Martinez, has been inspecting VeChain’s previous to make sense of its current and future. Martinez factors out some attention-grabbing similarities in VeChain’s value actions in 2020, suggesting that historical past may repeat itself. In accordance with Martinez, VeChain might be due for a pullback in the direction of $0.032 earlier than doubtlessly gearing up for a bullish run.

#VeChain appears to reflect its value actions from June to December 2020. If this sample holds, $VET may pull again to the channel’s higher boundary at $0.032, doubtlessly setting the stage for a continued bull run! pic.twitter.com/PVkpJZXW34

— Ali (@ali_charts) April 16, 2024

Vibrant Future Forward For VET?

Different specialists, equivalent to Clifton Fx and World of Charts lately predicted a promising future for VET. The previous insisted that the coin’s worth could enhance to $0.06 within the close to future, whereas the latter predicted it’d hit $0.22 this summer season.

Approaching $1

https://t.co/lC93xLRuEE pic.twitter.com/pic7N1WvvW

— FLASH (@THEFLASHTRADING) April 11, 2024

Flash made essentially the most bullish prognosis, claiming that VET goes to rise by 2,500% to achieve an all-time excessive of $1.

Buyers Maintain A Watchful Eye On Dips

In the meantime, with the market temper swinging in the direction of optimism, analysts are advising traders to play the ready sport. They recommend conserving a watch out for value dips and being affected person. Some even assume this might be the calm earlier than the storm, predicting that VeChain is likely to be gearing up for some severe positive aspects sooner or later.

In the long run, VeChain’s capability to remain afloat in uneven waters hasn’t gone unnoticed. Whereas it is probably not the flashiest participant within the crypto world, its regular efficiency is beginning to flip heads.

Featured picture from Yahoo Finance, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site solely at your individual danger.

[ad_2]

The post VeChain Value Poised For A Bullish Breakout? appeared first on kitko.

]]>The post Alpha | KPR Mill Ltd. appeared first on kitko.

]]>

KPR Mill Ltd. – Key participant within the textiles business.

Included in 2003 and headquartered in Coimbatore, KPR Mill Ltd. is likely one of the largest vertically built-in attire manufacturing firms in India. With state-of-the-art manufacturing amenities in Tamil Nadu and a worldwide footprint spanning 60 nations, the corporate’s diversified enterprise is unfold majorly throughout yarn, material, clothes, and white crystal sugar. As of 31 March 2023, KPR has a capability to provide 1,00,000 MTPA of Cotton yarn & 4,000 MTPA Viscose vortex yarn, 40,000 MTPA materials and 157 million readymade knitted attire every year. The corporate has additionally ventured into branded retail section by way of the launch of its in-house model FASO.

Merchandise and Providers

KPR has a various vary of product portfolio comprising readymade knitted attire, materials, compact, melange, carded, polyester, combed yarn and many others. Moreover, the corporate can also be within the enterprise of manufacturing white crystal sugar, ethanol and energy era.

Subsidiaries: As of FY23, the corporate has 7 subsidiaries.

Key Rationale

- Strong monitor report with stable consumer base – The corporate has export relationship with varied main worldwide manufacturers akin to Primark, Marks & Spencers, H&M and many others. Additional, cementing its confirmed monitor report of catering to main gamers, the corporate just lately added Walmart as buyer for US exports, and GAP to the US and Europe buyer record. The brand new consumer additions are anticipated to provide robust quantity traction to the corporate. Throughout Q3FY24, KPR pulled off an all-time excessive garment order e book of Rs.1,100 crore.

- Constant capex expansions – The corporate is increasing its processing capability with an outlay of Rs.250 crore together with solar energy plant at a Rs.100 crore capex spend (capability of 25MW) taking the photo voltaic and wind capability to 100 MW. It just lately accomplished establishing of vortex spinning mill at a capital outlay of Rs.100 crores, roof high solar energy plant with an funding of Rs.50 crore and ethanol capability enlargement at current sugar mills at a capital outlay of Rs.150 crores. With this the capability of current sugar mill ethanol capability has elevated from 120 KLPD to 250 KLPD. It additionally accomplished the greenfield processing & printing enlargement at Rs.50 crores to match the processing capability to fulfill the prevailing garment capability.

- Sugar/Ethanol section – The ethanol manufacturing is anticipated to take a success given the government-imposed restrictions on utilizing sugarcane juice to provide ethanol. Despite the fact that ethanol manufacturing from B-Heavy molasses and C-Heavy molasses will proceed as ordinary, the corporate has estimated a 40% discount in ethanol manufacturing changing right into a Rs.200 crore income dip throughout the season. It’s aiming to compensate this loss from the marginally improved sugar costs from final yr. Moreover, increased than anticipated sugar yield may lead to authorities enjoyable the restrictions at present imposed. The corporate has given a manufacturing steerage of seven – 8 crore litres of ethanol and a couple of lakhs tonnes for sugar for the present yr.

- Q3FY24 – Through the quarter, income declined by 12% from Rs.1,445 crore of Q3FY23 to Rs.1,269 crore of Q3FY24. Working revenue improved marginally by 1% to Rs.272 crore from the Rs.269 crore of Q3FY23. Web revenue improved by 7% to Rs.187 crore. Through the quarter, the corporate needed to take the affect of fall in sugar worth and consequent fall in worth of yarn, margin reduce in yarn as a result of subdued demand in worldwide markets, garment cargo delay as a result of cyclone in Tamil Nadu and the federal government ban on utilizing sugar cane juice for ethanol manufacturing. Phase-wise margin achieved by the corporate is as follows – Yarn & Material margin – 15%, Garment – 27%, Sugar – 27%.

- Monetary efficiency – KPR has generated a income and PAT CAGR of 23% and 30% over the interval of three years (FY20-23). Common 3-year ROE & ROCE is round 26% and 27% for FY20-23 interval. The corporate has robust stability sheet with a strong debt-to-equity ratio of 0.21.

Business

The basic power of the textile business in India is its robust manufacturing base of a variety of fibre/yarns from pure fibres like cotton, jute, silk and wool, to artificial/man-made fibres like polyester, viscose, nylon and acrylic. India is likely one of the largest producers of cotton and jute on the earth. With 4.6% share of the worldwide commerce, India is the world’s largest producer and third largest exporter of textiles and attire on the earth. India ranks among the many high 5 world exporters in a number of textile classes, with exports anticipated to succeed in US$ 65 billion by FY26. Cotton manufacturing in India is projected to succeed in 7.2 million tonnes by 2030, pushed by rising demand from shoppers. India enjoys a comparative benefit by way of expert manpower and in price of manufacturing, relative to main textile producers. Rising demand for on-line purchasing can also be anticipated to help the expansion of textile manufacturing market.

Development Drivers

- 100% FDI is allowed underneath automated route in textile business.

- Rs.4,389.24 crore (US$ 536.4 million) whole allocation for textile sector in Union Finances for FY23-24.

- Numerous authorities schemes such because the Scheme for Built-in Textile Parks (SITP), Expertise Upgradation Fund Scheme (TUFS) and Mega Built-in Textile Area and Attire (MITRA) Park scheme.

Rivals: Web page Industries Ltd, Gokaldas Exports Ltd and many others.

Peer Evaluation

Compared to the above opponents, KPR Mill is essentially the most undervalued mid-cap inventory with higher returns on the capital employed and steady development in gross sales.

Outlook

The way forward for the Indian textiles business appears promising, buoyed by robust home consumption in addition to export demand. The corporate expects to realize improve in gross sales volumes by advantage of improve in capability throughout clothes, spinning, sugar and ethanol divisions. It’s eyeing a development of 10% to 12% development in clothes section. Apart from constant capability additions within the core textiles enterprise, strategic investments within the sugar/ethanol enterprise will assist maintain the expansion momentum. The corporate is anticipating a scale as much as a variety of Rs.10 crore per thirty days run charge from FASO.

Valuation

We count on a gentle choose up in volumes and realisations for KPR Mill Ltd given the corporate’s important market share within the demand pushed business and capability expansions. Nevertheless, we count on the sugar/ethanol division to stay underneath stress as a result of head winds. We advocate a BUY ranking within the inventory with the goal worth (TP) of Rs.974 34x FY25E EPS.

Dangers

- Centralised manufacturing amenities – All the firm’s manufacturing amenities are positioned in Tamil Nadu. Any unprecedented actions or unanticipated local weather circumstances on this area may pose a hindrance for the continuation of operations.

- Foreign exchange Danger – The corporate has important operations in overseas markets and therefore is uncovered to foreign exchange threat. Any unexpected motion within the foreign exchange market can adversely have an effect on the corporate.

Recap of our earlier suggestions (As on 12 Apr 2024)

Different articles you might like

Publish Views:

577

The post Alpha | KPR Mill Ltd. appeared first on kitko.

]]>The post All the things it’s essential to learn about Automated Investing in 2024 appeared first on kitko.

]]>At its coronary heart, automated investing is about using expertise to tackle the duty of managing your funding portfolio. It’s a way the place algorithms and software program are used to execute trades and handle belongings based mostly on predefined standards equivalent to your threat tolerance, funding objectives, and time horizon. This technology-driven method assesses market circumstances, executes purchase and promote orders, and rebalances your portfolio to keep up its alignment together with your monetary objectives, all with out the necessity for every day enter.

This type of investing is commonly related to robo-advisors—digital platforms that present automated, algorithm-driven monetary planning providers with minimal human supervision. The great thing about automated investing lies in its skill to make knowledgeable, well timed selections, leveraging huge quantities of knowledge to navigate the complexities of the market. It democratizes monetary administration, providing refined funding methods that have been as soon as solely accessible to high-net-worth people or institutional traders.

Right here’s a more in-depth have a look at the way it works:

- Preliminary setup: Traders begin by finishing an in depth questionnaire that gauges their funding goals, threat tolerance, and monetary scenario. This important step ensures that the automated system has all the required data to create a tailor-made funding technique.

- Technique formulation: Utilizing the data gathered, the automated investing platform, normally by a robo-advisor, constructs a customized funding technique. It selects a mixture of asset courses and investments that align with the investor’s objectives and threat profile.

- Computerized execution: As soon as the technique is ready, the platform routinely executes trades to construct the portfolio. It makes use of algorithms to purchase and promote belongings in a method that matches the predetermined funding technique, taking into consideration the present market circumstances.

- Ongoing administration and rebalancing: Automated investing doesn’t cease at portfolio creation. The system constantly displays the portfolio, making changes and rebalancing as wanted to keep up the goal asset allocation.

- Tax optimization: Some automated investing platforms embrace options like tax-loss harvesting, that are methods designed to reduce taxes on funding features or earnings.

- Regulatory compliance and safety: Automated funding platforms adhere to regulatory requirements, making certain that each one funding selections are made with the investor’s greatest pursuits in thoughts. Additionally they make use of sturdy safety measures to guard traders’ monetary and private data.

By leveraging expertise, automated investing simplifies the funding course of, making it extra accessible and fewer intimidating for traders. It brings a degree of self-discipline and precision to portfolio administration that may be troublesome to realize by guide investing, permitting traders to learn from a hands-off method whereas nonetheless working in direction of their monetary objectives.

The post All the things it’s essential to learn about Automated Investing in 2024 appeared first on kitko.

]]>The post Binance Receives Full Operational Approval for Crypto Providers in Dubai appeared first on kitko.

]]>Binance has introduced that it has acquired a full

virtual-asset companies supplier (VASP) license from Dubai’s Digital Property

Regulatory Authority (VARA). This improvement comes almost a yr after Binance

entered the third stage of Dubai’s four-stage regulatory course of.

In response to a VARA submitting, Binance’s native unit, Binance

FZE, secured an Operational MVP license in mid-2023. This preliminary license

enabled the trade to cater to institutional and certified buyers,

providing broker-dealer companies in addition to virtual-asset derivatives buying and selling.

Binance FZE Common Supervisor Alex Chehade emphasised the

significance of the complete VASP license, stating that it “underlines Dubai’s

place as a forward-thinking metropolis – acknowledging and embracing the monetary

potential that blockchain know-how brings.”

Richard Teng. Supply: LinkedIn

“As we safe the esteemed full market VASP Licence, it

notably amplifies our unwavering dedication to advancing the monetary

panorama by means of compliance and innovation,” the CEO, Richard Teng stated in a

assertion. “This achievement embodies our dedication to transparency,

regulatory compliance, and accountable progress within the dynamic digital property

area.”

Binance CEO Richard Tang tells @VonnieQuinn the digital-asset trade has acquired its long-sought full crypto license in Dubai https://t.co/eOXTsmr2NV pic.twitter.com/5ShdRw0Hag

— Bloomberg (@enterprise) April 18, 2024

Studies point out that one situation connected to the license

required Binance’s Co-Founder and former CEO, Changpeng “CZ” Zhao, to

relinquish voting management inside the native unit. CZ at present awaits sentencing

in america after settling prices with the Division of Justice in

November. His sentencing is scheduled for April 30.

#Binance is proud to have acquired a Digital Asset Service Supplier (VASP) licence from Dubai’s Digital Property Regulatory Authority (VARA).

This milestone permits us to increase our companies to the retail market alongside certified and institutional buyers.

Learn extra

— Binance (@binance) April 18, 2024

Binance Implements Governance Construction with Seven-Member

Board

Binance

Holdings has established a seven-member Board of Administrators after almost

seven years since its inception, as reported by Finance Magnates. Gabriel Abed,

former Ambassador of Barbados to the UAE, assumes the function of Chair.

The Board

includes key figures together with CEO Teng, Co-Founder Heina Chen, Xin Wang of

Bayview Acquisition Corp, Arnaud Ventura of Gojo & Firm, and former

Binance workers Lilai Wang and Jinkai. This transfer, spearheaded by CEO Teng,

marks a step for Binance in direction of accountability, following management adjustments

prompted by authorized challenges.

Binance has introduced that it has acquired a full

virtual-asset companies supplier (VASP) license from Dubai’s Digital Property

Regulatory Authority (VARA). This improvement comes almost a yr after Binance

entered the third stage of Dubai’s four-stage regulatory course of.

In response to a VARA submitting, Binance’s native unit, Binance

FZE, secured an Operational MVP license in mid-2023. This preliminary license

enabled the trade to cater to institutional and certified buyers,

providing broker-dealer companies in addition to virtual-asset derivatives buying and selling.

Binance FZE Common Supervisor Alex Chehade emphasised the

significance of the complete VASP license, stating that it “underlines Dubai’s

place as a forward-thinking metropolis – acknowledging and embracing the monetary

potential that blockchain know-how brings.”

Richard Teng. Supply: LinkedIn

“As we safe the esteemed full market VASP Licence, it

notably amplifies our unwavering dedication to advancing the monetary

panorama by means of compliance and innovation,” the CEO, Richard Teng stated in a

assertion. “This achievement embodies our dedication to transparency,

regulatory compliance, and accountable progress within the dynamic digital property

area.”

Binance CEO Richard Tang tells @VonnieQuinn the digital-asset trade has acquired its long-sought full crypto license in Dubai https://t.co/eOXTsmr2NV pic.twitter.com/5ShdRw0Hag

— Bloomberg (@enterprise) April 18, 2024

Studies point out that one situation connected to the license

required Binance’s Co-Founder and former CEO, Changpeng “CZ” Zhao, to

relinquish voting management inside the native unit. CZ at present awaits sentencing

in america after settling prices with the Division of Justice in

November. His sentencing is scheduled for April 30.

#Binance is proud to have acquired a Digital Asset Service Supplier (VASP) licence from Dubai’s Digital Property Regulatory Authority (VARA).

This milestone permits us to increase our companies to the retail market alongside certified and institutional buyers.

Learn extra

— Binance (@binance) April 18, 2024

Binance Implements Governance Construction with Seven-Member

Board

Binance

Holdings has established a seven-member Board of Administrators after almost

seven years since its inception, as reported by Finance Magnates. Gabriel Abed,

former Ambassador of Barbados to the UAE, assumes the function of Chair.

The Board

includes key figures together with CEO Teng, Co-Founder Heina Chen, Xin Wang of

Bayview Acquisition Corp, Arnaud Ventura of Gojo & Firm, and former

Binance workers Lilai Wang and Jinkai. This transfer, spearheaded by CEO Teng,

marks a step for Binance in direction of accountability, following management adjustments

prompted by authorized challenges.

[ad_2]

The post Binance Receives Full Operational Approval for Crypto Providers in Dubai appeared first on kitko.

]]>The post Crypto Dealer Predicts Subsequent 100x Alternative After 170x And 520x appeared first on kitko.

]]>One of many crypto neighborhood’s most notable merchants for the time being, Ansem (@blknoiz06), has not too long ago ignited curiosity along with his newest prediction, claiming one other potential 100x alternative. This time, his focus is on a brand new growth on the Bitcoin community, which he believes is at the moment undervalued by the market.

Ansem said by way of X:

Subsequent 100x opp is runes on Bitcoin, 95% of CT isn’t listening to this in any respect examine volumes on Solana memecoins to present unisat quantity & take into account the wealth impact if Bitcoiners have their very own native altcoins to purchase provenance will b v imp right here additionally imo.

An In-depth Evaluation Of Ansem’s Successes

Lookonchain, a good on-chain evaluation agency, offered an exhaustive have a look at Ansem’s newest buying and selling historical past and technique. Their evaluation reveals a sample of early investments in nascent cryptocurrencies that later turned extremely profitable.

Ansem(@blknoiz06) – the most effective crypto dealer who:

170x on $SOL

520x on $WIF

80x on $BONKYesterday, he tweeted that the subsequent 100x opp is runes on Bitcoin.

1/

Let’s dig into his buying and selling technique. pic.twitter.com/vN2N2Aekbz— Lookonchain (@lookonchain) April 17, 2024

On January 1, 2021, Ansem invested in Solana when it was priced at simply $1.5. By November of the identical yr, the worth of Solana had skyrocketed to $260, a return that considerably outpaced market expectations, netting a acquire of over 170x.

Ansem’s acute sense of market potential was once more on show along with his investments in WIF and BONK. His tweet on December 12, 2023, suggesting that WIF had potential just like SHIB (Shiba Inu), preceded a large surge in WIF’s worth from $0.09 to $4.85.

Equally, his endorsement of BONK led to a formidable 80x improve in its value. “On October 30, 2023, Ansem tweeted ‘bonk nice coin’, after which BONK skyrocketed! 4 months later, BONK exceeded $0.000047,” the agency said.

Lookonchain additional highlighted, “Ansem combines a strategic allocation of 70% in long-term holdings with 30% devoted to short-term, speculative trades. This balanced strategy helps mitigate threat whereas capitalizing on high-return alternatives. His success is a testomony to his deep market insights, disciplined funding technique, and well timed execution.”

How To Observe The Crypto Merchants’ Prediction

In response, outstanding crypto analyst Cyclop (@nobrainflip), who boasts 346,000 followers, analyzed Ansem’s present prediction. He defined that the hype revolves round a newly developed protocol named Runes, created by the inventor of Ordinals, Rodarmor. Runes permits for the issuance of fungible tokens instantly on the Bitcoin community, working as a extra built-in different to the BRC-20 protocol.

Not like BRC-20, which follows an account mannequin akin to Ethereum’s, Runes makes use of Bitcoin’s UTXO (Unspent Transaction Output) mannequin, doubtlessly providing a extra seamless integration with Bitcoin’s current infrastructure.

Notably, Runes will not be simply another; they purpose to exchange the BRC-20 fully. The protocol costs charges in BTC for creating tokens and is ready to launch on Bitcoin’s halving day, April 19. The event of the Runes ecosystem is gaining traction, with numerous initiatives, instruments, and platforms starting to emerge.

With the anticipated launch of Runes scheduled for Bitcoin’s subsequent halving day on April 19, the ecosystem round this new protocol is rapidly creating. Quite a lot of initiatives are already making ready to make the most of Runes, with instruments, launchpads, and different assets being actively developed.

Probably the most notable, in line with cyclop, are:

- Runecoin (RSIC): This mission permits customers to mine tokens in anticipation of the Runes launch. It has already distributed a 21,000 RSIC miner airdrop to over 9,000 wallets that maintain Ordinal collections.

- Runes Terminal (RUNI): Aimed toward builders, this platform is making a take a look at surroundings for Bitcoin functions that may make the most of the Runes Protocol, facilitating innovation and simplification within the transition to new functions on the Bitcoin community.

- Pups Token (PUPS): With a pre-mint provide of 10 million tokens, this mission plans an airdrop for holders of Rune Pup ordinals, who also can take part in token-burning occasions to cut back provide and doubtlessly improve worth.

The crypto analyst additionally suggested that the hype round Runes is simply beginning. The “Ordinals neighborhood has spurred quite a few initiatives to supply Runes airdrops. Due to Magic Eden, a brand new tab now conveniently lists all collections confirmed to distribute Runes to holders in a single place.”

At press time, PUPS traded at $48.96, down 68% from its all-time excessive.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal threat.

[ad_2]

The post Crypto Dealer Predicts Subsequent 100x Alternative After 170x And 520x appeared first on kitko.

]]>The post April 1, 2024 | Mutual Fund Observer appeared first on kitko.

]]>Expensive buddies,

It’s April. I spent a lot of the Easter weekend sporting a t-shirt out to work within the gardens. It was wonderful. Right now, the forecast is for hail. Tomorrow? Snow.

Subsequent week? Oh, I don’t know … dragon fireplace?

And nonetheless, it behooves us to be thankful for what we have now. The world’s most corrosive pressure will not be greed. It’s envy, which is pushed by the sense that what we have now simply isn’t sufficient, and bitterness that others have extra. That’s a theme that Charlie Munger mirrored on repeatedly: “I’ve conquered envy in my very own life. I don’t envy anyone. I don’t give a rattling what another person has. However different individuals are pushed loopy by it.” How loopy? Hmmm … assume Biblically loopy: “If you wish to discuss future implications, quite a lot of what I see now jogs my memory of Sodom and Gomorrah. You get exercise feeding on itself, frenzies of envy and imitation” (2005).

It will definitely even contaminated his sidekick, Warren Buffett: “There isn’t any purpose to take a look at the minuses in life. It might be loopy. We depend our blessings.” (Sure, I do know. Simpler mentioned in case you’re price $90 billion.)

The joyful secret to it’s that the blessings don’t must be giant in an effort to be significant. Jancee Dunn, writing within the New York Occasions “Nicely” publication, mirrored on her anxious day on the Occasions when she couldn’t work out how you can log in to the corporate’s community, was terrified that somebody might overhear her fumbling on the cellphone, and so snuck off to satisfy one of many Wizards within the IT division (Chip assures me that she hires solely wizards-in-training in IT.). Adnan The Wizard mounted her downside, commiserated, and shared a thought:

He informed me to think about a jar and instructed that I add a metaphorical penny to it each time I achieved one thing — even a activity as small as discovering my method again to my desk.

Over time, he mentioned, you’ll replenish the jar. You will notice that you’re transferring ahead, even while you don’t really feel that you’re, he added.

I nonetheless take into consideration that jar, particularly once I’m having a tough time. I nonetheless deposit “pennies.” (“Feeling Overwhelmed? Attempt Tallying Your Tiny Wins,” NYT.com, 3/29/2024)

And so, within the face of hail and uncertainty, I have a good time my blessings: a loving household that I work to deserve, a significant calling and the belief of the households that make it attainable, the sight of a bald eagle spiraling lazily above the tennis courts simply past my window, time with all of you people, and the indicators that nature will give me one other probability this 12 months.

On this month’s Observer

One among my particular blessings is the power to work with people whose understanding of points is profound and sophisticated and whose willingness to translate that understanding to your profit appears boundless. Devesh, having spent knowledgeable lifetime buying and selling billions of {dollars} in choices, completes his Choices Trilogy for you this month. In March 2024, Devesh performed out current traits in choices markets as he examined the virtually manic rush into such funds. This month completes the trilogy with a deeper dive into the workings of choices in 10 funds and a mirrored image on The Choices Conundrum, together with the query of whether or not you may not revenue extra with a Replicant Portfolio: an ultra-low-cost fairness index and T-bills. readers ought to begin with Choices Based mostly Funds – a deeper dive.

Lynn presents two items this month. First, he updates his profile of Constancy New Millennium ETF (FMIL) by noting that … effectively, it’s gone. Constancy launched a set of lively ETFs final month, one in every of which absorbed and remodeled FMIL. Lynn shares his evaluation of the suite on provide. Second, he analyzes the choices of funds for long-term tax-efficient investing and comes up with two suggestions for you.

Lastly, The Shadow brings us updated on small victories for buyers (umm, okay, a bit quick there this month), the business’s new methods for Inexperienced Flight (rename the fund, redescribe the technique, and, failing that, bail out), and we bid farewell to a near-record variety of funds.

My contribution this month facilities on this essay, the place we’ll take a look at the market’s illusory calm, two investments you actually wish to discover, one you may pray to keep away from, and a bunch of iterations on the identical query: greed or envy, happiness or satisfaction?

I’ve two initiatives underway for you that try that can assist you take into consideration methods for coping with unstable markets.

Infrastructure investing: as nationwide governments fail to decelerate the speed of local weather change, sub-national governments are more and more planning huge infrastructure expenditures to mitigate a number of the results on human communities. Infrastructure bills are likely to function in a rhythm impartial of the inventory market, which makes them helpful for diversification. I’ve reached out to groups with three of essentially the most promising funds. To this point, I’ve bought one “we’ll get again to you” and two lifeless silences. (Actually, guys, take down the d**med “media contact” hyperlink in case you’re incapable of even a well mannered “no thanks.”) I’ll proceed these outreach efforts.

High quality investing: “high quality at an affordable worth” displays a exceptional market anomaly. The shares of high-quality corporations are typically underpriced, strong in up-markets, and distinctive in unstable ones. The online impact is increased long-term returns with decrease short-term volatility, which (concept says) shouldn’t occur. And it undoubtedly shouldn’t occur constantly. Nevertheless it does. A straightforward case may be made for the brand new GMO US High quality Fairness ETF; as a matter of reality, we have made it, Chip was satisfied to purchase it, and it has simply outperformed its five-star, $10 billion sibling. We’ve been working with a Morningstar strategist who recognized ten distinctive funds with an emphasis on high quality investing. He shared commentary on every, and we’re nonetheless figuring out an understanding of what’s immediately quotable and attributable.

Slightly than share half-complete initiatives, we’ve moved each to be featured tales in our Could 2024 challenge.

And why, you ask, fear about investments for unstable markets when the present market is eminently secure and rising? (Nicely, besides that the Magnificent Seven have been lowered to the Fabulous 4.)

“Markets have a false sense of safety”

The Wall Road Journal is likely to be channeling their interior Devesh. They observe that there’s been a flood of cash into options-backed funds and ETFs, however the information will not be all good. Jon Sindreu (3/8/2024) writes:

Should you purchased so-called structured merchandise lately, you could have loads of firm. However is exactly their reputation that would make them – and maybe your complete inventory market – riskier than they appear … The discount usually appeals to less-sophisticated buyers who in any other case may not dabble in advanced derivatives. For banks they bring about in fats charges.

There follows a dialogue of 1 class of derivatives referred to as “autocallables.” At base, banks are the counterparties within the autocallable commerce, so that they have the motivation to hope for market stability, which, partly, is attributable to their very own want to purchase “insurance coverage” towards their publicity to those choices. Sindreu summarizes:

So autocallables look engaging as a result of the inventory market is calm, however the market is calm as a result of individuals are shopping for so many autocallables. The suggestions loop is harking back to the one created by funds that immediately wagered towards volatility again in 2017 and 2018. When a bout of promoting broke the cycle, banks stopped hedging, volatility exploded and the market tanked.

His conclusion: you shouldn’t belief the Vix as a gauge of potential hassle. Quoting Jeffrey Yu of BNY Mellon, “Low volatility begets low volatility. Till one thing goes unsuitable.”

Per week later, a second Journal author echoed the warning:

The inventory market is calmer than it has been in years. Some fear {that a} in style technique is contributing to the tranquility.

Measures of market volatility have fallen to ranges final seen in 2018 …

Buyers are looking for safety from potential losses by pouring cash into [covered-call ETFs] … belongings in such funds has topped $67 billion, up from $7 billion on the finish of 2020.

Their argument is that this type of herd commerce (in volatility ETFs) “blew up in spectacular vogue six years in the past.” The choices commerce now exceeds shares in worth, with each covered-call place essentially matched over an reverse place in “name overwrites.” The priority is that this can be a advanced, leveraged construction that is likely to be catastrophically susceptible to an exterior shock that causes a cascading rush to the exits. (See Charley Grant, “In style guess weighs on volatility,” WSJ, 3/26/2024, B1. It’s on-line with a paywall and a barely totally different title.)

Each are good items and remind us that one of the best time to patch the roof is earlier than the rain begins. Our Could options are aimed in that route.

Excellent news, good guys, GoodHaven

Morningstar Journal featured GoodHaven Fund, which we profiled in July 2023 (“The Rise of GoodHaven Fund“), in their March 2024 challenge. Our fast abstract: exceptional turnaround. Distinctive portfolio. Disciplined supervisor.

Morningstar Journal featured GoodHaven Fund, which we profiled in July 2023 (“The Rise of GoodHaven Fund“), in their March 2024 challenge. Our fast abstract: exceptional turnaround. Distinctive portfolio. Disciplined supervisor.

We, they usually, each observe the supervisor’s principled choice to revamp his technique in late 2020. The concept was to focus extra on “particular conditions” provided that they have been demonstrably “particular” and “high quality at an affordable worth” technique moderately than specializing in purely statistical measures of cheapness.

It’s working.

Comparability of 3-Yr Efficiency (April 2021 – March 2024)

| APR | Max drawdown | Draw back deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

|

| GoodHaven | 17.3% | -17.8 | 10.1 | 6.6 | 0.86 | 1.44 | 2.19 |

| Multi-Cap Worth friends | 8.6 | -18.0 | 10.8 | 6.4 | 0.35 | 0.55 | 1.06 |

| S&P 500 | 11.5 | -23.9 | 11.6 | 10.0 | 0.50 | 0.75 | 0.88 |

Supply: MFO Premium fund screener and Lipper World knowledge feed

Methods to learn that?

Returns: APR means the annual proportion return for the interval

Dangers: the utmost drawdown and draw back deviation (referred to as “dangerous deviation”) measure draw back volatility for the interval. In these circumstances, decrease is best.

Threat-return stability: the Ulcer Index measures how far an funding falls and the way lengthy it takes to rebound. Smaller (as in “it gave me a smaller ulcer”) is best. The Sharpe, Sortino, and Martin ratios assess an funding’s returns towards an more and more excessive risk-management bar; that’s, Martin is rather more risk-averse than Sharpe. In every case, increased is best.

By these measures, GoodHaven has been a uniform and constant winner. Morningstar frets that the fund “might not have broad attraction” as a result of it doesn’t match neatly right into a field. So I assume in case you care about bins, you may flip to The Container Retailer. Should you care extra about efficiency, you may add GoodHaven to your due diligence checklist.

Microcap fairness funds price consideration

I contributed, in partnership with Mark Gill, to a chunk entitled “Microcap Funds” within the March 6, 2024 challenge of Backside Line. Backside Line is a type of cool “a little bit of this and a little bit of that” publication that covers private subjects from finance to diet and scholarship sources. I contribute sometimes. Mark and his editors assess reader curiosity in numerous subjects, and one of many writers reaches out to speak with me. We speak. I share ideas and knowledge. He drafts, I revise.

The premise is that microcaps are profoundly undervalued relative to a bunch of measures and have a tendency to carry out exceptionally effectively when rates of interest start to fall since that usually indicators a interval of financial acceleration. The MFO Premium screens recognized about ten choices, and Mark picked up on three.

With a bit more room, I’d have urged him – and also you – to research Pinnacle Worth (PVFIX), which is a five-star fund managed by John E. Deysher. The fund embodies a low turnover, absolute worth technique that permits the supervisor to carry substantial money when compelling alternatives are few.

With a bit more room, I’d have urged him – and also you – to research Pinnacle Worth (PVFIX), which is a five-star fund managed by John E. Deysher. The fund embodies a low turnover, absolute worth technique that permits the supervisor to carry substantial money when compelling alternatives are few.

Shallow observers will say, “he’s been within the backside 10% of his peer group 4 occasions within the final ten years.” Those that look nearer may observe that John’s market cap is one-twentieth of his peer group’s, and he’s posted double-digit absolute returns in three of these 4 years. 2017 is the one truly dangerous 12 months. In each interval we observe – whether or not 3/5/10 12 months home windows or market cycles – Pinnacle’s Sharpe ratio ranges from “a lot increased” than its friends (50% increased since inception) to “ridiculously increased” (400% increased over the previous three years). The fund’s customary deviation is half of the group’s.

One measure of the success of an absolute worth technique is the fund’s huge outperformance, measured in APR or annualized proportion charges, throughout the current bear markets.

| 2007-09 GFC | 2020 Covid bear | 2022 bear | Full cycle – 2022 bear + subsequent bull | |

| Pinnacle Worth | -24.8% | -23.3 | -7.7 | 12.5 |

| Small worth common | -53.6 | -38.0 | -18.0 | 4.7 |

John manages about $34 million in belongings, barely above the place he was in 2015 after we profiled the fund. Our conclusion, then and now, is identical:

Mr. Deysher would favor to provide his buyers the chance to earn prudent returns, sleep effectively at night time, and, ultimately, revenue richly from the irrational conduct of the mass of buyers. Over the previous decade, he’s pulled that off higher than any of his friends (2015).

“Irrational conduct of the mass of buyers”? The place have I heard that earlier than? Hmmm…

John is a laconic soul, so studying his 2023 Annual Report takes modestly much less time than ending your morning cup of espresso.

Trump in your portfolio

Extra appropriately, Trump Media (DJT). Mr. Trump’s firm, previously Fact Social, is now publicly traded on the Nasdaq alternate. Over the week previous April 1, 2024, it had a share worth of between $43-73, giving it a considerably unstable market cap. Its peak capitalization was $8 billion. It spent a lot of the final week of March at round $7 billion and started April at $5.5 billion. By way of market cap, that’s within the neighborhoods of Etsy, Hasbro, Voya, or Invesco. About 5,000,000 shares a day have been buying and selling fingers. In 2023, the corporate had gross sales of $4 million (giving it a worth/gross sales ratio of 1200) and misplaced $58 million (giving it a detrimental p/e ratio of minus 70). By comparability, the median annual gross sales of a McDonald’s location in 2020 was $2,908,000.

As a result of accounting is magical, the firm reported a $50.5 million revenue in 2022 on $1.5 million in income.

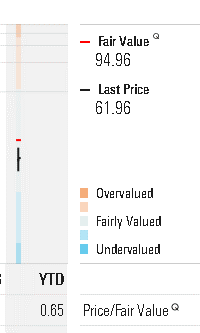

As a result of computer systems are magical, Morningstar’s algorithms have calculated a good market worth for DJT at $94.96 (as of April 1, 2024).

Not , you say?

You may not have a alternative. The itemizing standards for shares within the Russell 3000 index are:

- Itemizing on a US inventory alternate

- A share worth above $1.00 on a rating day on the finish of Could

- A market cap above $30 million

- A free market float of greater than 5% (that’s, greater than 5% of the corporate’s complete shares have to be buying and selling on the open market)

We have now reached out to FTSE Russell, a part of the London Inventory Alternate Group, to know their inclusion course of however haven’t but obtained a response.

Skilled athletes and the economics of envy

There’s been a lamentable lot of commentary these days about Nationwide Soccer League gamers on $40 million/12 months contracts who deserve $60 million contracts. Their insistence on holding out for these previous couple of tens of millions displays the truth that “they gotta maintain their households.”

Actually?

The typical American “takes care of their household” on $51,480 a 12 months. (The Census stories family moderately than particular person incomes; the median there’s $75,000 in 2022.) Loves them, hugs them, goes to their Little League video games and piano recitals, cleans up their messes, and binds their wounds, psychic and bodily. A 2014 examine by the Georgetown Middle on Schooling and the Workforce concluded, “General, the median lifetime earnings for all staff are $1.7 million,” with considerably increased payouts for people with a BA ($2.3M), MA ($2.7M), PhD ($3.2M, and actually I’ve bought to search out somebody to sue over the hole between me and what I’m apparently owed) and MD/JD ($3.6M).

I’m, as lots of you already know, a child from Pittsburgh. In 1977, within the midst of a span through which the Steelers gained 4 Tremendous Bowls, future Corridor of Fame gamers Joe Greene and Lynn Swann made $60,000 / 12 months, roughly four-and-a-half occasions the common earnings for all People that 12 months. After all, they performed for a man, Artwork Rooney Sr., who walked to work each morning. In 2024 phrases, a future Corridor of Fame participant making 4 and a half occasions the common earnings could be hauling in a cool $230,000 a 12 months!

In actuality, $40 million contracts replicate that you just and I are rather more all for watching sports activities occasions than in collaborating – a parent-coach, sponsor, ref, athlete – in a single. Our rapt consideration to their fantasy world underwrites huge contracts and, sometimes, delusional conduct. You may not be extra completely satisfied getting out to the (native) ballfield, however on the finish of the day, you may end up moderately extra happy. Which cues …

In memoriam … Daniel Kahneman (March 5, 1934 – March 27, 2024)

Dr. Kahneman handed away on the age of 90 after a life effectively and absolutely lived. He was acknowledged by The Economist because the world’s seventh most influential economist. That’s placing as a result of (a) our fetish for meaningless rankings makes me smile, and (b) he wasn’t an economist.

Dr. Kahneman handed away on the age of 90 after a life effectively and absolutely lived. He was acknowledged by The Economist because the world’s seventh most influential economist. That’s placing as a result of (a) our fetish for meaningless rankings makes me smile, and (b) he wasn’t an economist.

By “wasn’t an economist,” I imply “by no means even took a single Econ course in faculty.”

Kahneman was a professor of psychology whose work, together with Amos Tversky, laid the premise for the disciplines of behavioral economics and behavioral finance. His elementary achievement was to categorize the constant patterns of cognitive weirdness; others then discovered methods to make uncounted billions by exploiting these patterns. His guide Considering: Quick and Sluggish (2011) comprises findings central to my instructing on propaganda and mass manipulation, however it’s additionally central to the curriculum of enterprise packages throughout the nation. Dr. Kahneman obtained the Nobel Prize in 2002, the Presidential Medal of Freedom in 2013, two dozen honorary doctorates, and numerous skilled awards, together with the Leontief Prize for contributions that “help simply and sustainable societies.”

His less-known work on happiness and satisfaction aligns with my opening reflections on this letter. Kahneman and colleagues did moderately quite a lot of work on the topic, solely to find that most individuals don’t need to be completely satisfied. They wish to be happy. Happiness, he concluded, was the fleeting sensation of pleasure in a specific second. It was evanescent. Satisfaction, he argued, “is a long-term feeling, constructed over time and based mostly on attaining objectives and constructing the type of life you admire.”

Charlie Munger would, I feel, perceive. Stepping by means of the doorway of your million-dollar dwelling and basking within the awe of your mates may make you cheerful. Dwelling in an unassuming dwelling and spending a part of every week constructing shelters for others – as Lynn Bolin does and Jimmy Carter did – is likely to be a surer highway to satisfaction.

Thanks!

Due to Tom & Mes from TN, our previous good friend Gary in PA (I’ll share a bit extra in Could, however I’m very assured this will probably be an amazing 12 months), and John of Honolulu.

To our devoted subscribers: Wilson, Gregory, William, William, Stephen, Brian, David, and Doug. The month-to-month reminders of your help imply quite a bit.

Within the Could Observer, I look ahead to the case for infrastructure funds, high quality investing, two fixed-income choices, and common merriment. We hope to see you there!

The post April 1, 2024 | Mutual Fund Observer appeared first on kitko.

]]>The post SoFi Limitless 2% Credit score Card Will get Reward Enhance appeared first on kitko.

]]>The SoFi Limitless 2% Credit score Card¹ already focuses on rewarding our members merely. The cardboard, which fees zero annual price†, incorporates a host of advantages that will help you get your cash proper, together with limitless 2% money again rewards² on all purchases redeemable as assertion credit score or in the direction of saving, investing, or paying down eligible SoFi debt. Right this moment, we’re launching a brand new characteristic that rewards our most loyal members much more–a ten% enhance on money again rewards earned for bank card members with direct deposit by way of SoFi Checking³. That’s limitless 2.2% money again rewards on all purchases, and even 3.3% on journeys booked by way of SoFi Travel⁴. In contrast to different promotional provides, the ten% enhance doesn’t expire and has no limits on how a lot you may earn from the profit.

How does this work? It’s easy. Open a SoFi Limitless 2% Credit score Card and arrange direct deposit by way of SoFi Checking & Financial savings. As soon as your first paycheck arrives by way of direct deposit, you’ll mechanically begin incomes limitless 2.2% money again rewards on all of your purchases. So long as you keep your direct deposit by way of SoFi Checking & Financial savings and proceed to make use of the SoFi Limitless 2% Credit score Card, additionally, you will proceed to earn the reward enhance. This new profit isn’t just for brand new cardholders. Present bank card members with direct deposit into their SoFi Checking and Financial savings account may even start mechanically receiving the ten% enhance.

Further SoFi Limitless 2% Credit score Card advantages embody:

–ID Theft Protection⁵ & Zero Fraud Legal responsibility provide you with peace of thoughts by placing Id Theft decision providers at your fingertips and making certain you aren’t accountable for unauthorized transactions

-No international transaction charges on purchases made overseas

-A 24/7 journey concierge service and month-to-month Lyft credit to make getting round simpler and extra affordable⁶

-Complimentary 2-day transport by way of ShopRunner6

-Entry to free credit score rating and monetary monitoring to regulate your cash and see how your credit score rating is impacted by your spending⁷

Prepared to spice up your money again rewards to limitless 2.2%? Click on right here† to start.

DISCLOSURES

¹SoFi Credit score Playing cards are issued by SoFi Financial institution, N.A. pursuant to license by Mastercard® Worldwide Integrated and can be utilized in all places Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard Worldwide Integrated.

†See Pricing, Phrases & Situations at SoFi.com/card/phrases

²Members earn 2 rewards factors for each greenback spent on purchases. No rewards factors shall be earned with respect to reversed transactions, returned purchases, or different comparable transactions. Once you elect to redeem rewards factors into your SoFi Checking or Financial savings account, SoFi Cash® account, SoFi Lively Make investments account, SoFi Credit score Card account, or SoFi Private, Personal Scholar, or Scholar Mortgage Refinance, your rewards factors will redeem at a price of 1 cent per each level. For extra particulars, please go to the Rewards web page. Brokerage and Lively investing merchandise provided by way of SoFi Securities LLC, Member FINRA/SIPC. SoFi Securities LLC is an affiliate of SoFi Financial institution, N.A..Rewards factors, which in flip might be redeemed as money rewards, are earned with each eligible buy made with the SoFi Credit score Card for a buyer who’s in good standing. No factors shall be earned with respect to reversed transactions, returned purchases, or different comparable transactions. See Rewards Particulars<SoFi.com/card/rewards> for extra info on eligible purchases.

³10% Enhance on Money Again Rewards Factors for SoFi Credit score Card Purchases: Members who meet the eligibility standards shall earn a ten% enhance on money again rewards charges for all eligible purchases made with a SoFi Credit score Card (the “Promotion”). A ten% enhance implies that a ten% multiplier shall be utilized to present money again rewards charges (e.g., 10% x 2% money again rewards price = 0.2% enhance). For instance, eligible members shall earn 2.2% money again rewards factors on on a regular basis purchases, 3.3% money again rewards factors on SoFi Journey purchases, and 27.5% money again rewards factors on SoFi Stadium purchases. For functions of calculating the ten% enhance on money again rewards factors, every transaction shall be rounded to the closest greenback, and fractional factors shall be rounded to the closest complete level. The ten% enhance shall not apply to (i) transactions that aren’t eligible for money again rewards factors, as set forth within the SoFi Credit score Card Rewards Phrases or (ii) courtesy rewards factors which are manually awarded. SoFi shall, in its sole discretion, decide whether or not a transaction is eligible to earn the ten% enhance beneath this Promotion.

To be eligible for this Promotion, you will need to obtain a Direct Deposit into your SoFi Checking or Financial savings account through the Promotion Interval. You have to obtain a Direct Deposit throughout every 30-Day Analysis Interval (as outlined beneath) to proceed to obtain the ten% enhance. Direct Deposit means a deposit into an account holder’s SoFi Checking or Financial savings account, together with payroll, pension, or authorities funds (e.g., Social Safety), made by the account holder’s employer, payroll or advantages supplier or authorities company (“Direct Deposit”) by way of the Automated Clearing Home (“ACH”) Community. Deposits that aren’t from an employer or authorities company, together with however not restricted to verify deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, and so forth.), service provider transactions (e.g., transactions from PayPal, Stripe, Sq., and so forth.), and financial institution ACH funds transfers and wire transfers from exterior accounts, don’t represent Direct Deposit exercise and don’t qualify for this Promotion.

The 30-Day Analysis Interval refers back to the “Begin Date” and “Finish Date” set forth on the APY Particulars web page of your account, which contains a interval of 30 calendar days (the “30-Day Analysis Interval”). You may entry the APY Particulars web page at any time by logging into your SoFi account on the SoFi cell app or SoFi web site and choosing both (i) Banking > Financial savings > Present APY or (ii) Banking > Checking > Present APY. Upon receiving a Direct Deposit to your account, you’ll start incomes the ten% enhance on money again rewards. You’ll proceed to earn the ten% enhance for (i) the rest of the present 30-Day Analysis Interval and thru the tip of the next 30-Day Analysis Interval and (ii) any following 30-day Analysis Durations throughout which SoFi Financial institution determines you to have Direct Deposit exercise with out interruption. SoFi Financial institution reserves the proper to grant a grace interval to account holders following a change in Direct Deposit exercise earlier than terminating your 10% enhance profit. If SoFi Financial institution grants you a grace interval, the dates for such grace interval shall be mirrored on the APY Particulars web page of your account. If SoFi Financial institution determines that you simply didn’t obtain a Direct Deposit through the present 30-day Analysis Interval and, if relevant, the grace interval, then you’ll now not earn the ten% enhance till you may have Direct Deposit exercise in a subsequent 30-Day Analysis Interval. In sure instances, it might take as much as 90 days on your Direct Deposit to be acknowledged, after which you’ll start incomes the ten% enhance on money again rewards. If you don’t see your 10% enhance on money again rewards profit after 90 days, please contact our assist middle.

Promotion Interval: The Promotion will start on 4/1/24 at 1:00 PM ET. SoFi reserves the proper to terminate or make modifications to this Promotion at any time.

Eligible Individuals: All new and present SoFi Credit score Card members who obtain a Direct Deposit into their SoFi Checking or Financial savings account through the Promotion Interval are eligible for this Promotion. You have to obtain a Direct Deposit throughout every 30-Day Analysis Interval to proceed to obtain the ten% enhance. A member shall not earn the ten% enhance beneath this Promotion if they’re at the moment incomes 3% money again rewards factors beneath the three% Money Again Rewards Promotion. When you at the moment profit from the three% Money Again Rewards Promotion, then you’ll proceed to earn 3% money again rewards factors till you’re both now not eligible or till the expiration of such profit, as supplied within the 3% Money Again Rewards Promotion phrases. Upon the expiration of your 3% money again rewards factors profit, you’ll be eligible to earn the ten% enhance beneath this Promotion, supplied that you simply meet the eligibility standards said herein. Provide restricted to 1 per SoFi Checking and Financial savings account. A SoFi Credit score Card account will solely profit from the ten% enhance beneath this Promotion if the first SoFi Credit score Card account holder receives a Direct Deposit into their SoFi Checking or Financial savings account (or, within the case of a joint Checking and Financial savings account, a joint account holder receives a Direct Deposit). SoFi reserves the proper to exclude any member from taking part on this Promotion for any purpose, together with suspected fraud, misuse, or if suspicious actions are noticed.

⁴Terms, and circumstances apply: The SoFi Journey Portal is operated by Expedia. To be taught extra about Expedia, click on https://www.expediagroup.com/dwelling/default.aspx

Once you use your SoFi Credit score Card to make a purchase order on the SoFi Journey Portal, you’ll earn a variety of SoFi Member Rewards factors equal to three% of the full quantity you spend on the SoFi Journey Portal. Members can save as much as 10% or extra on eligible bookings

Eligibility:

You should be a SoFi registered person.

You have to conform to SoFi’s privateness consent settlement.

You have to e book the journey on SoFi’s Journey Portal reached straight by way of a hyperlink on the SoFi web site or cell utility. Journey booked straight on Expedia’s web site or app, or some other web site operated or powered by Expedia shouldn’t be eligible.

You have to pay utilizing your SoFi Credit score Card.

SoFi Member Rewards: All phrases relevant to using SoFi Member Rewards apply. To be taught extra please see: https://www.sofi.com/rewards/

Phrases relevant to Member Rewards: https://www.sofi.com/terms-of-use/#rewards

Further Phrases:

Adjustments to your bookings will have an effect on the Rewards stability for the acquisition.

Any canceled bookings or fraud will trigger Rewards to be rescinded.

Rewards might be delayed by as much as 7 enterprise days after a transaction posts on Members’ SoFi Credit score Card ledger.

SoFi reserves the proper to withhold Rewards factors for suspected fraud, misuse, or suspicious actions.

©2024 SoFi Financial institution, N.A. All rights reserved. Member FDIC. Equal Housing Lender. NMLS #696891 (Member FDIC), (www.nmlsconsumeraccess.org).

⁵Mastercard ID Theft Safety : This World Elite Mastercard® Profit comes at no further price. Cardholders have to register for this service. To activate your alerts profit, go to mastercardus.idprotectiononline.com and enter your card quantity to start out the registration course of. Sure phrases, circumstances, and exclusions apply. This service is supplied by Generali International Help, Inc. Please see your information to advantages <https://www.mastercard.us/en-us/private/find-a-card/world-elite-mastercard-credit.html> for particulars or name 1-800-MASTERCARD.

: This World Elite Mastercard® Profit comes at no further price. Cardholders have to register for this service. To activate your alerts profit, go to mastercardus.idprotectiononline.com and enter your card quantity to start out the registration course of. Sure phrases, circumstances, and exclusions apply. This service is supplied by Generali International Help, Inc. Please see your information to advantages <https://www.mastercard.us/en-us/private/find-a-card/world-elite-mastercard-credit.html> for particulars or name 1-800-MASTERCARD.

⁶Certain World Elite Mastercard® Advantages have further phrases and circumstances, which might be accessed by way of the World Elite Mastercard® Advantages portal. Please see your information to advantages <https://www.mastercard.us/en-us/private/find-a-card/world-elite-mastercard-credit.html> for particulars or name 1-800-MASTERCARD.

⁷SoFi Relay provides customers the flexibility to attach each SoFi accounts and exterior accounts utilizing Plaid, Inc.’s service. Once you use the service to attach an account, you authorize SoFi to acquire account info from any exterior accounts as set forth in SoFi’s Phrases of Use. Primarily based in your consent SoFi may even mechanically present some monetary information acquired from the credit score bureau on your visibility, with out the necessity of you connecting further accounts. SoFi assumes no accountability for the timeliness, accuracy, deletion, non-delivery, or failure to retailer any person information, lack of person information, communications, or personalization settings. You shall affirm the accuracy of Plaid information by way of sources unbiased of SoFi. The credit score rating is a VantageScore® based mostly on TransUnion® (the “Processing Agent”) information.

©2024 Social Finance, LLC. All rights reserved.

The post SoFi Limitless 2% Credit score Card Will get Reward Enhance appeared first on kitko.

]]>The post All Quiet On The Bitcoin ETF Entrance appeared first on kitko.

]]>The current approval and launch of spot Bitcoin ETFs have caused notable adjustments in market dynamics. Among the many most vital gamers affected is Grayscale, a number one establishment within the crypto area.

Grayscale’s Bitcoin Holdings Expertise Decline

Grayscale, identified for its Bitcoin Belief (GBTC), held the best BTC market capitalization amongst establishments. Nonetheless, an in-depth evaluation reveals a decline in its Bitcoin holdings over current months.

From almost 620,000 BTC in January, Grayscale’s holdings have dwindled to a bit over 300,000 BTC on the time of reporting. This decline raises questions in regards to the components influencing institutional funding methods within the crypto sector.

Spot Bitcoin ETFs Witness Fluctuating Flows

Following the launch of spot Bitcoin ETFs, the market has witnessed fluctuating flows throughout numerous platforms. Whereas sure ETFs have skilled important quantity, others have recorded zero flows, indicating a combined response from traders. BlackRock’s IBIT and Grayscale’s GBTC have been among the many few to register notable flows, with each inflows and outflows noticed in current days.

Supply: Coinglass

A better have a look at the info reveals consecutive outflows in Bitcoin spot ETFs over the previous few days, paying homage to related traits noticed in March. On the fifteenth and sixteenth of April, outflows amounted to just about $27 million and $58 million, respectively.

Regardless of these outflows, analysts level out that such fluctuations are usually not unusual within the ETF market and will not essentially point out product failure.

Evaluation Of Movement Patterns Offers Perception

Analyzing particular movement patterns provides invaluable insights into investor conduct and market sentiment. Whereas Grayscale’s GBTC skilled consecutive outflows, BlackRock’s IBIT noticed inflows on sure days. This variance underscores the various methods adopted by traders in response to the evolving crypto panorama.

Bitcoin market cap at present at $1.2 trillion. Chart: TradingView.com

It’s vital to notice that zero inflows on sure days are thought of regular for ETFs, in keeping with analysts. They emphasised that such occurrences are commonplace throughout numerous ETFs and shouldn’t be interpreted as an indication of product failure. As a substitute, they replicate the ebb and movement of investor curiosity in a quickly evolving market.

Future Outlook For Bitcoin ETFs

As Bitcoin ETFs proceed to realize traction, the market is poised for additional evolution. Whereas some platforms might expertise fluctuations in flows, the general trajectory of institutional funding within the crypto sector stays optimistic.

The approval and launch of spot Bitcoin ETFs have sparked shifts in market dynamics, impacting establishments like Grayscale and prompting fluctuations in ETF flows. Regardless of the volatility, analysts stay optimistic in regards to the long-term prospects of Bitcoin ETFs and their function in shaping the way forward for finance.

Featured picture from DataDrivenInvestor, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site solely at your personal danger.

The post All Quiet On The Bitcoin ETF Entrance appeared first on kitko.

]]>The post The Urlacher Makes a Full S19k Professional 115T ASIC Miner Run on 120V appeared first on kitko.

]]>

8

Dec

2023

The Loki Package by Pivotal Pleb Tech has made it simpler for crypto miners to get artistic and run numerous configurations of Bitmain S19 ASIC miners on 120V energy, which means house mining for these gadgets was made potential in US and different international locations utilizing this voltage. There are variety of merchandise already out there utilizing Loki and single S19 mining boards to make a great house heater for the winter such because the BitChimney House Heater and StealthMiner, however now there’s a new attention-grabbing choice out there as effectively referred to as The Urlacher. The gadget is known as after LuxOS engineer David Urlacher who first constructed this configuration, and is a triple hashboard Loki Rig with absolutely purposeful Antminer S19k professional that runs on 120V energy at decrease hashrate. We’re engaged on a evaluate of the BitChimney House Heater already as we now have ordered a unit some time in the past and it has arrived, so we’re already enjoying round with it.

The Urlacher is attention-grabbing on account of the truth that it runs a daily S19k Professional miner with all of its mining boards at decrease working frequency to attain excessive hashrate and excessive effectivity for house mining and it comes as a better modification that may be rapidly utilized. No have to disassemble the entire miner to take out hashing boards or to construct customized instances and it’s simpler to return the miner again to its authentic type that can hash at full pace with the common non-120V energy provide. You may get the entire miner with the modification or simply the modification equipment to use to your individual miner when you have one, or you may construct one your self with only a Loki Package, a Bitmain APW3++ PSU and another equipment to attach and make every thing work. The Urlacher does 56 TH/s at 1200 Watts of energy utilization with 53 dB noise degree, although you may play with settings to attain totally different outcomes so long as you slot in the full energy capabilities of the ability provide.

– For extra details about The Urlacher out there from Altair Tech…

Verify Some Extra Comparable Crypto Associated Publications:

The post The Urlacher Makes a Full S19k Professional 115T ASIC Miner Run on 120V appeared first on kitko.

]]>