The post BlackRock’s Bitcoin ETF achieves legendary standing after hitting second-largest inflows for 2024 appeared first on kitko.

]]>

What’s CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and data, powered by Entry Protocol. Study extra ›

Linked to Alpha

Welcome!  You’re linked to CryptoSlate Alpha. To handle your pockets connection, click on the button under.

You’re linked to CryptoSlate Alpha. To handle your pockets connection, click on the button under.

Essential: You will need to lock a minimal of 20,000 ACS

If you do not have sufficient, purchase ACS on the next exchanges:

Join through Entry Protocol

Entry Protocol is a web3 monetization paywall. When customers stake ACS, they will entry paywalled content material. Study extra ›

Disclaimer: By selecting to lock your ACS tokens with CryptoSlate, you settle for and acknowledge that you’ll be sure by the phrases and situations of your third-party digital pockets supplier, in addition to any relevant phrases and situations of the Entry Basis. CryptoSlate shall haven’t any duty or legal responsibility with regard to the availability, entry, use, locking, safety, integrity, worth, or authorized standing of your ACS Tokens or your digital pockets, together with any losses related together with your ACS tokens. It’s solely your duty to imagine the dangers related to locking your ACS tokens with CryptoSlate. For extra data, go to our phrases web page.

The post BlackRock’s Bitcoin ETF achieves legendary standing after hitting second-largest inflows for 2024 appeared first on kitko.

]]>The post Bitcoin Value Reclaims $70K And Indicators Recent Surge To $75K appeared first on kitko.

]]>Bitcoin worth is rising and now buying and selling above $70,000 resistance zone. BTC might proceed to rise towards the $73,000 and $75,000 ranges within the close to time period.

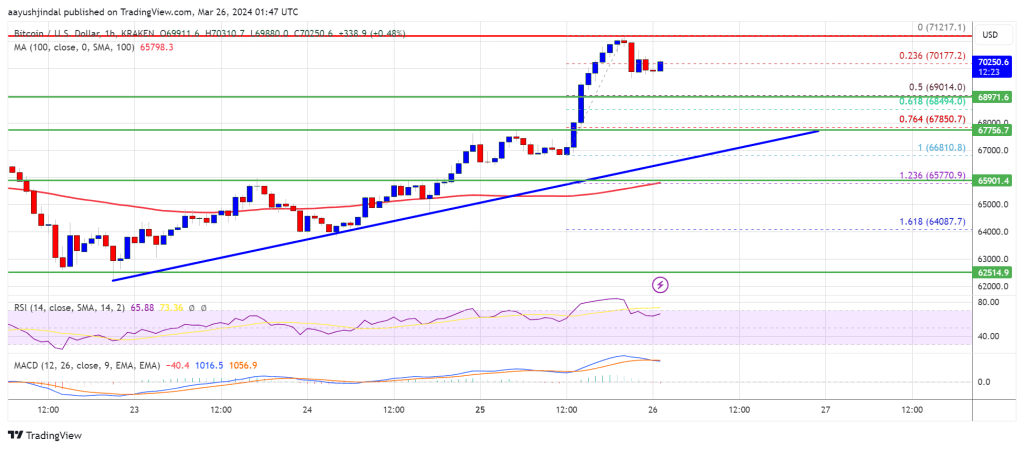

- Bitcoin worth remained in a constructive zone above the $66,500 degree.

- The worth is buying and selling above $70,000 and the 100 hourly Easy transferring common.

- There’s a connecting bullish development line forming with assist at $67,500 on the hourly chart of the BTC/USD pair (information feed from Kraken).

- The pair might proceed to rise if it clears the $71,200 resistance zone.

Bitcoin Value Restarts Enhance

Bitcoin worth remained secure above the $65,000 resistance zone. BTC climbed larger above the $67,500 and $68,000 resistance ranges. The bulls even pumped the value above the $68,800 and $70,000 resistance ranges.

A brand new weekly excessive was fashioned close to $71,217 and the value is now consolidating positive factors. It’s buying and selling close to the 23.6% Fib retracement degree of the upward transfer from the $66,810 swing low to the $71,217 excessive. Bitcoin can also be buying and selling above $70,000 and the 100 hourly Easy transferring common.

There may be additionally a connecting bullish development line forming with assist at $67,500 on the hourly chart of the BTC/USD pair. The development line is near the 76.4% Fib retracement degree of the upward transfer from the $66,810 swing low to the $71,217 excessive.

Supply: BTCUSD on TradingView.com

Fast resistance is close to the $70,500 degree. The primary main resistance might be $71,200. If there’s a clear transfer above the $71,200 resistance zone, the value might proceed to realize power. Within the said case, the value might even clear the $73,500 resistance zone within the close to time period. The following key resistance sits at $75,000.

One other Drop In BTC?

If Bitcoin fails to rise above the $71,200 resistance zone, it might begin one other decline. Fast assist on the draw back is close to the $70,000 degree.

The primary main assist is $69,000. The following assist sits at $67,800 and the development line. If there’s a shut beneath $67,800, the value might begin a drop towards the $66,800 degree. Any extra losses would possibly ship the value towards the $65,500 assist zone within the close to time period.

Technical indicators:

Hourly MACD – The MACD is now shedding tempo within the bullish zone.

Hourly RSI (Relative Power Index) – The RSI for BTC/USD is now above the 60 degree.

Main Help Ranges – $69,000, adopted by $67,800.

Main Resistance Ranges – $70,500, $71,200, and $73,500.

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site solely at your personal danger.

The post Bitcoin Value Reclaims $70K And Indicators Recent Surge To $75K appeared first on kitko.

]]>The post SWIFT completes second check part of CBDC with sensible contract, atomic settlement functionality appeared first on kitko.

]]>

SWIFT stated on March 25 that it found a number of functions for its central financial institution digital forex (CBDC) answer following a profitable six-month check.

The corporate didn’t create its personal CBDC however as an alternative developed an interlinking answer for current CBDCs — dubbed the SWIFT connector.

The corporate wrote:

“On the core of our answer is the DLT and sensible contract layer, which maintains constant information of transactions.”

SWIFT broadly described the platform as having functions in digital commerce, securities, and overseas commerce. It additionally famous that future variations of the platform may very well be expanded to areas past CBDCs, comparable to bank-led tokenized deposit networks.

Good contracts for TradFi

Particular use circumstances embody commerce funds, overseas trade, supply versus fee (DvP), and liquidity-saving mechanisms.

SWIFT stated its sandbox answer includes a number of digital ledger know-how (DLT) networks. The corporate used Hyperledger Besu for the tokenization platform. It used R3 Corda and Hyperledger Material for purchaser and vendor networks and settlement directions.

SWIFT additionally described atomic settlements and swaps, a blockchain or DLT-based strategy to settlement involving the moment and simultaneous trade of two property. This kind of settlement is much like supply versus fee (DVP) in conventional monetary networks.

The platform additionally used sensible contracts to routinely be sure that funds have been executed as soon as situations have been met. All 4 of SWIFT’s main use circumstances concerned using sensible contracts.

Largest check of its variety

SWIFT stated its sandbox check concerned 38 establishments over six months and known as it “one of many largest identified CBDC experiments so far” on this regard.

It added that, when it comes to community exercise, over 125 sandbox customers carried out greater than 750 transactions within the course of. About 60 representatives from taking part monetary establishments participated in 20 collaborative working group conferences to debate use circumstances.

The corporate plans to develop a manufacturing roadmap for the SWIFT connector however famous that progress shall be primarily based on “market developments and readiness.”

The service might meet rising curiosity in CBDCs around the globe. International locations with lively CBDCs embody China, the Bahamas, Jamaica, and Nigeria. At the very least 130 different international locations and areas are additionally exploring CBDCs, with current developments in Europe, the Philippines, and Spain.

Talked about on this article

The post SWIFT completes second check part of CBDC with sensible contract, atomic settlement functionality appeared first on kitko.

]]>The post Ripple execs reveal SEC in search of $2 billion in fines, say regulator has ‘turn out to be unhinged’ appeared first on kitko.

]]>

Ripple CEO Brad Garlinghouse and CLO Stuart Alderoty have revealed that the SEC is in search of a staggering $2 billion in fines and penalties.

Based on the corporate’s executives, the fines have been proposed in a courtroom submitting that can be unsealed on March 26.

‘Unhinged’ SEC

Garlinghouse mentioned the SEC is in search of heavy penalties regardless of its claims involving “no allegations … of fraud or recklessness.” He added that there’s “completely no precedent” for the request and asserted that Ripple’s response will “expose” the SEC.

In one other tweet, Garlinghouse condemned the SEC by referencing an earlier resolution that discovered the SEC lacked “devoted allegiance to the legislation” in its remedy of Ripple.

Chris Larsen, co-founder and government chairman of Ripple, additionally commented, writing:

“Gensler’s SEC has turn out to be unhinged.”

Larsen added that the watchdog “thinks it’s above the legislation” and argued that this mentality has precipitated the US to lag behind different nations. He emphasised that the regulator’s failings “shouldn’t … go unnoticed in an election 12 months.”

A Republican victory on this 12 months’s US elections might result in the SEC being restructured, presumably changing present SEC chair Gary Gensler.

In the meantime, Alderoty individually asserted the SEC is “bent on eager to punish and intimidate Ripple.” He added that the regulator “trades in statements which can be false, mischaracterized, and designed to mislead.”

Institutional gross sales

Earlier rumors steered that Ripple might face a fantastic above $2 billion based mostly on institutional gross sales of XRP, as previous rulings solely discovered that these choices constituted securities gross sales.

On Feb. 26, Ashley Prosper recognized 4.9 billion XRP of institutional gross sales in a courtroom submitting, resulting in widespread predictions of $2.6 billion in fines based mostly on a $0.55 token worth.

Nonetheless, as of March 25, XRP is priced considerably increased at $0.66, placing the worth of the identical 4.9 billion XRP at $3.2 billion. Which means that the SEC’s supposed fantastic is both not based mostly on the present XRP worth or is lower than the entire institutional sale quantity.

Programmatic gross sales of XRP, together with on-exchange gross sales, didn’t represent securities. The SEC additionally dropped allegations that Garlinghouse and Larsen’s private XRP gross sales have been securities. As such, these sale quantities probably didn’t contribute to the SEC’s presently requested fantastic.

The publish Ripple execs reveal SEC in search of $2 billion in fines, say regulator has ‘turn out to be unhinged’ appeared first on CryptoSlate.

[ad_2]

The post Ripple execs reveal SEC in search of $2 billion in fines, say regulator has ‘turn out to be unhinged’ appeared first on kitko.

]]>The post Why the Media Is Seemingly Much less Serious about Bitcoin Than Ever appeared first on kitko.

]]>

Then got here the pandemic rally, in 2021, when crypto mania actually set in, inextricably tied up with the retail investor revolution, WallStreetBets and GameStop, stonks, non-fungible tokens (NFTs) and memes. Investing turned a public social exercise for the very-online. Then one other crash. And now the present rally, during which bitcoin has soared above $72,000, pushed by the approval of spot bitcoin exchange-traded funds (ETF) and institutional adoption from large fits like BlackRock and Constancy. In fact, with crypto it’s by no means only one factor driving it, and the present rally just isn’t simply concerning the ETF, however I believe it is going to be most simply remembered and characterised that approach.

The post Why the Media Is Seemingly Much less Serious about Bitcoin Than Ever appeared first on kitko.

]]>The post London Inventory Trade units Could 28 launch date for Bitcoin, Ethereum ETNs appeared first on kitko.

]]>

The London Inventory Trade mentioned in a March 25 discover that it plans for Bitcoin (BTC) and Ethereum (ETH) crypto exchange-traded notes (ETNs) to start buying and selling on Could 28.

The newest announcement additionally particulars different key dates. The London Inventory Trade will start accepting functions for admission from issuers on April 8. The FCA should additionally determine on base prospectuses that intend to launch on the primary day of buying and selling by Could 22.

Issuers aiming for the Could 28 launch date should submit a letter detailing how their ETN satisfies all necessities in a factsheet plus a base prospectus draft by April 15.

The trade mentioned its chosen launch date would permit the utmost variety of issuers to be current on the primary buying and selling day. That date will give candidates time to organize related documentation and permit the trade to guage whether or not issuers fulfill necessities.

The launch date relies on the Monetary Conduct Authority (FCA) approving base prospectuses from candidates, because the authority should record crypto ETNs on its Fundamental Market and Official Record.

Earlier expectations

On March 11, the London Inventory Trade mentioned it could settle for functions within the second quarter of 2024 however didn’t present a exact date.

It additionally supplied a factsheet detailing varied necessities, together with a block on retail buying and selling. Related funds should even be non-leveraged and bodily backed by Bitcoin or Ethereum, held a minimum of 90% in chilly storage or an equal methodology, and stored with a certified custodian.

Impartial from the London Inventory Trade, the FCA mentioned on March 20 that it could not object to requests to create crypto ETNs from Recognised Funding Exchanges.

The UK’s obvious willingness to allow crypto ETNs is notable as these autos present skilled buyers within the nation with new methods to spend money on crypto.

Although crypto ETNs are much like exchange-traded funds (ETF) in that they monitor the worth of the underlying crypto, they in any other case differ in lots of points of their design.

The submit London Inventory Trade units Could 28 launch date for Bitcoin, Ethereum ETNs appeared first on CryptoSlate.

[ad_2]The post London Inventory Trade units Could 28 launch date for Bitcoin, Ethereum ETNs appeared first on kitko.

]]>The post How one can Enhance Transparency and Public Belief in Crypto Markets appeared first on kitko.

]]>

These legislative efforts are novel in utilizing blockchain know-how’s noteworthy public transparency and auditability performance. Blockchains monitor debits and credit to accounts on a ledger, similar to an extraordinary accounting system, however in a real-time, clear, and immutable vogue. The existence of any asset that resides on a public blockchain, whether or not a tokenized safety or a digital commodity, is verifiable by clients and regulators. This isn’t the case for off-chain transactions, which don’t commit digital asset transactions to the suitable blockchain. As an alternative, data of off-chain transactions are saved within the buying and selling platform’s inside methods and never recorded on the blockchain. In consequence, clients depend on the interior recordkeeping of unregistered buying and selling platforms to trace their report of possession.

The post How one can Enhance Transparency and Public Belief in Crypto Markets appeared first on kitko.

]]>The post Key Occasions That You Ought to Maintain An Eye On This Week appeared first on kitko.

]]>There are a couple of occasions to be careful for this week, as they might show pivotal in figuring out the longer term trajectory of the crypto market. These occasions might present some certainty to the market or trigger traders to attend on the sidelines for extra favorable market circumstances.

Occasions That May Have an effect on The Market This Week

Some Federal Reserve officers are scheduled to talk at completely different occasions this week. Considered one of them is Governor Lisa Prepare dinner, who will give a lecture on March 25. Fed Chair Jerome Powell will even take part in a dialogue on the Financial Coverage Convention on March 29.

Their speeches are important as they might present worthwhile insights into the present state of the financial system and what to anticipate from the Federal Reserve concerning rates of interest in its battle towards inflation. Macroeconomic elements like rates of interest often affect the crypto market and partly decide the emotions amongst crypto merchants.

The crypto market is often bullish at any time when the Federal Reserve adopts a dovish stance on whether or not or to not hike rates of interest. Subsequently, these officers sounding optimistic of their speeches might assist increase traders’ confidence within the crypto market since they might be much less nervous about issues on the macro aspect.

In the meantime, a number of financial knowledge can be launched this week, together with the Client Confidence and Client Sentiment knowledge and the Private Consumption Expenditures (PCE) index. These releases supply insights into the financial system’s power and information the Fed in deciding on future rate of interest selections.

Crypto Wants A Large Win This Week

Stakeholders and traders within the trade will little question hope that the occasions lined up for this week will present a momentum increase for the crypto market. Final week was one to overlook as issues cooled after weeks of seeing the flagship crypto, Bitcoin, and altcoins make important runs. This downward pattern is believed to have been resulting from some exterior elements.

Considered one of them is the web outflows that the Spot Bitcoin ETFs recorded all through final week, with many traders taking earnings from the varied funds. These Bitcoin ETFs had beforehand seen a formidable quantity of inflows into them, which positively affected Bitcoin’s value. As such, a pattern of outflows was additionally anticipated to affect Bitcoin’s value, though negatively.

These Spot Bitcoin ETFs will once more be within the highlight this week, with the crypto group ready to see if the emotions among the many ETF traders will change. A sustained pattern of profit-taking this week might spark one other decline within the crypto market.

Whole market cap chart at $2.47 trillion | Supply: Crypto Whole Market Cap on Tradingview.com

Featured picture from CNBC, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site solely at your personal threat.

The post Key Occasions That You Ought to Maintain An Eye On This Week appeared first on kitko.

]]>The post Canary community testing proposed after AMM launch points on Ripple’s XRP Ledger appeared first on kitko.

]]>

Ripple‘s developer arm, RippleX, revealed that a few of the lately launched Automated Market Maker (AMM) swimming pools on XRP Ledger (XRPL) encountered technical points that prevented transactions from processing appropriately.

In a March 24 assertion on X (previously Twitter), the builders mentioned:

“The discrepancy affected how the DEX fee engine routes liquidity by AMM swimming pools and order books in some complicated fee path eventualities.”

David Schwartz, the CTO of Ripple, additional defined that the difficulty didn’t originate from the single-sided deposit characteristic, because it aligns with the supposed performance of the AMM design. He added:

“Single-sided deposits permit for a extra streamlined consumer expertise, however can result in value impacts when swimming pools have much less liquidity. It’s greatest for customers to evaluation the worth influence of their tooling earlier than submitting a transaction and front-end apps ought to show this data to customers.”

AMMs had been launched on XRPL on March 22 after the neighborhood had waited two years. The venture was designed to unlock further liquidity sources and buying and selling alternatives for XRPL customers.

Nevertheless, because of the early teething issues, AMM customers have been suggested in opposition to depositing new funds into these swimming pools till the difficulty is resolved.

Moreover, RippleX revealed {that a} proposed answer is below neighborhood evaluation and can quickly be put to an modification voting course of.

‘Canary community’

XRPL developer Wietse Wind proposed the idea of a Canary community for the blockchain community in response to the challenges encountered in the course of the launch of AMM.

In accordance with him:

“The current discovering of a bug within the freshly launched AMM on the XRP Ledger exhibits the necessity for higher testing. Testing with actual worth, on a community that isn’t mainnet. Testing when an modification is obtainable, not when it was voted in and went stay.”

The Canary community would function independently with its native tangible asset. This setup will encourage real-life utilization, offering a sensible surroundings for customers and builders to check and determine vulnerabilities.

Notably, Wind’s thought echoes present practices in blockchain improvement, resembling Ethereum’s utilization of a number of testnets like Sepolia. These check environments function essential platforms for testing upgrades and amendments earlier than their deployment on the mainnet.

The put up Canary community testing proposed after AMM launch points on Ripple’s XRP Ledger appeared first on CryptoSlate.

[ad_2]

The post Canary community testing proposed after AMM launch points on Ripple’s XRP Ledger appeared first on kitko.

]]>The post Final week’s market correction spurred $942 million outflow from funding merchandise appeared first on kitko.

]]>

Crypto-related funding merchandise skilled a downturn after a streak of report inflows, with a complete outflow of $942 million reported final week, based on CoinShares‘ newest weekly report.

This marks the primary occasion of outflows up to now eight weeks, signaling the conclusion of a formidable seven-week influx totaling $12.3 billion.

Market correction impacts crypto merchandise

The substantial outflows noticed coincide with a worth correction within the crypto market, with Bitcoin’s worth dropping to a multi-week low of $60,976 and different digital belongings following swimsuit.

James Butterfill, CoinShares’ analysis head, defined that this market correction slashed $10 billion from the entire belongings underneath administration (AuM) for crypto-related funding merchandise. However, the present steadiness of $88 billion stands notably above earlier market cycle ranges.

Moreover, the general buying and selling quantity for these funding merchandise declined to $28 billion in comparison with over $40 billion recorded within the previous two weeks.

Notably, this adverse market efficiency engendered bearish sentiments amongst buyers, leading to diminished inflows of simply $1.1 billion into the brand new spot Bitcoin ETFs within the US.

Consequently, the modest inflows couldn’t offset the substantial $2 billion outflows recorded from Grayscale‘s Bitcoin Belief (GBTC). Consequently, Bitcoin-related merchandise ended the week with a adverse web movement of $904 million.

Ethereum additionally sustained outflows for the second consecutive week, with $34.2 million exiting the asset. This brings its month-to-date movement to a adverse $46.2 million.

Different merchandise, equivalent to Multiassets and Solana, additionally skilled outflows of $7.3 million and $5.6 million, respectively.

In the meantime, the adverse sentiment reverberated globally, with merchandise in numerous areas, together with the US, Germany, Switzerland, Hong Kong, and Sweden, all witnessing outflows. Nonetheless, Canada and Brazil skilled minor inflows of $8.4 million and $9 million, respectively.

Curiously, even quick Bitcoin positions skilled an outflow of $3.7 million final week.

On a brighter notice, lesser-known cryptocurrencies equivalent to XRP, Polkadot, Avalanche, and Litecoin noticed modest inflows, indicating a constructive week for these belongings amidst the broader market downturn.

Talked about on this article

The post Final week’s market correction spurred $942 million outflow from funding merchandise appeared first on kitko.

]]>