The post Alpha | KPR Mill Ltd. appeared first on kitko.

]]>

KPR Mill Ltd. – Key participant within the textiles business.

Included in 2003 and headquartered in Coimbatore, KPR Mill Ltd. is likely one of the largest vertically built-in attire manufacturing firms in India. With state-of-the-art manufacturing amenities in Tamil Nadu and a worldwide footprint spanning 60 nations, the corporate’s diversified enterprise is unfold majorly throughout yarn, material, clothes, and white crystal sugar. As of 31 March 2023, KPR has a capability to provide 1,00,000 MTPA of Cotton yarn & 4,000 MTPA Viscose vortex yarn, 40,000 MTPA materials and 157 million readymade knitted attire every year. The corporate has additionally ventured into branded retail section by way of the launch of its in-house model FASO.

Merchandise and Providers

KPR has a various vary of product portfolio comprising readymade knitted attire, materials, compact, melange, carded, polyester, combed yarn and many others. Moreover, the corporate can also be within the enterprise of manufacturing white crystal sugar, ethanol and energy era.

Subsidiaries: As of FY23, the corporate has 7 subsidiaries.

Key Rationale

- Strong monitor report with stable consumer base – The corporate has export relationship with varied main worldwide manufacturers akin to Primark, Marks & Spencers, H&M and many others. Additional, cementing its confirmed monitor report of catering to main gamers, the corporate just lately added Walmart as buyer for US exports, and GAP to the US and Europe buyer record. The brand new consumer additions are anticipated to provide robust quantity traction to the corporate. Throughout Q3FY24, KPR pulled off an all-time excessive garment order e book of Rs.1,100 crore.

- Constant capex expansions – The corporate is increasing its processing capability with an outlay of Rs.250 crore together with solar energy plant at a Rs.100 crore capex spend (capability of 25MW) taking the photo voltaic and wind capability to 100 MW. It just lately accomplished establishing of vortex spinning mill at a capital outlay of Rs.100 crores, roof high solar energy plant with an funding of Rs.50 crore and ethanol capability enlargement at current sugar mills at a capital outlay of Rs.150 crores. With this the capability of current sugar mill ethanol capability has elevated from 120 KLPD to 250 KLPD. It additionally accomplished the greenfield processing & printing enlargement at Rs.50 crores to match the processing capability to fulfill the prevailing garment capability.

- Sugar/Ethanol section – The ethanol manufacturing is anticipated to take a success given the government-imposed restrictions on utilizing sugarcane juice to provide ethanol. Despite the fact that ethanol manufacturing from B-Heavy molasses and C-Heavy molasses will proceed as ordinary, the corporate has estimated a 40% discount in ethanol manufacturing changing right into a Rs.200 crore income dip throughout the season. It’s aiming to compensate this loss from the marginally improved sugar costs from final yr. Moreover, increased than anticipated sugar yield may lead to authorities enjoyable the restrictions at present imposed. The corporate has given a manufacturing steerage of seven – 8 crore litres of ethanol and a couple of lakhs tonnes for sugar for the present yr.

- Q3FY24 – Through the quarter, income declined by 12% from Rs.1,445 crore of Q3FY23 to Rs.1,269 crore of Q3FY24. Working revenue improved marginally by 1% to Rs.272 crore from the Rs.269 crore of Q3FY23. Web revenue improved by 7% to Rs.187 crore. Through the quarter, the corporate needed to take the affect of fall in sugar worth and consequent fall in worth of yarn, margin reduce in yarn as a result of subdued demand in worldwide markets, garment cargo delay as a result of cyclone in Tamil Nadu and the federal government ban on utilizing sugar cane juice for ethanol manufacturing. Phase-wise margin achieved by the corporate is as follows – Yarn & Material margin – 15%, Garment – 27%, Sugar – 27%.

- Monetary efficiency – KPR has generated a income and PAT CAGR of 23% and 30% over the interval of three years (FY20-23). Common 3-year ROE & ROCE is round 26% and 27% for FY20-23 interval. The corporate has robust stability sheet with a strong debt-to-equity ratio of 0.21.

Business

The basic power of the textile business in India is its robust manufacturing base of a variety of fibre/yarns from pure fibres like cotton, jute, silk and wool, to artificial/man-made fibres like polyester, viscose, nylon and acrylic. India is likely one of the largest producers of cotton and jute on the earth. With 4.6% share of the worldwide commerce, India is the world’s largest producer and third largest exporter of textiles and attire on the earth. India ranks among the many high 5 world exporters in a number of textile classes, with exports anticipated to succeed in US$ 65 billion by FY26. Cotton manufacturing in India is projected to succeed in 7.2 million tonnes by 2030, pushed by rising demand from shoppers. India enjoys a comparative benefit by way of expert manpower and in price of manufacturing, relative to main textile producers. Rising demand for on-line purchasing can also be anticipated to help the expansion of textile manufacturing market.

Development Drivers

- 100% FDI is allowed underneath automated route in textile business.

- Rs.4,389.24 crore (US$ 536.4 million) whole allocation for textile sector in Union Finances for FY23-24.

- Numerous authorities schemes such because the Scheme for Built-in Textile Parks (SITP), Expertise Upgradation Fund Scheme (TUFS) and Mega Built-in Textile Area and Attire (MITRA) Park scheme.

Rivals: Web page Industries Ltd, Gokaldas Exports Ltd and many others.

Peer Evaluation

Compared to the above opponents, KPR Mill is essentially the most undervalued mid-cap inventory with higher returns on the capital employed and steady development in gross sales.

Outlook

The way forward for the Indian textiles business appears promising, buoyed by robust home consumption in addition to export demand. The corporate expects to realize improve in gross sales volumes by advantage of improve in capability throughout clothes, spinning, sugar and ethanol divisions. It’s eyeing a development of 10% to 12% development in clothes section. Apart from constant capability additions within the core textiles enterprise, strategic investments within the sugar/ethanol enterprise will assist maintain the expansion momentum. The corporate is anticipating a scale as much as a variety of Rs.10 crore per thirty days run charge from FASO.

Valuation

We count on a gentle choose up in volumes and realisations for KPR Mill Ltd given the corporate’s important market share within the demand pushed business and capability expansions. Nevertheless, we count on the sugar/ethanol division to stay underneath stress as a result of head winds. We advocate a BUY ranking within the inventory with the goal worth (TP) of Rs.974 34x FY25E EPS.

Dangers

- Centralised manufacturing amenities – All the firm’s manufacturing amenities are positioned in Tamil Nadu. Any unprecedented actions or unanticipated local weather circumstances on this area may pose a hindrance for the continuation of operations.

- Foreign exchange Danger – The corporate has important operations in overseas markets and therefore is uncovered to foreign exchange threat. Any unexpected motion within the foreign exchange market can adversely have an effect on the corporate.

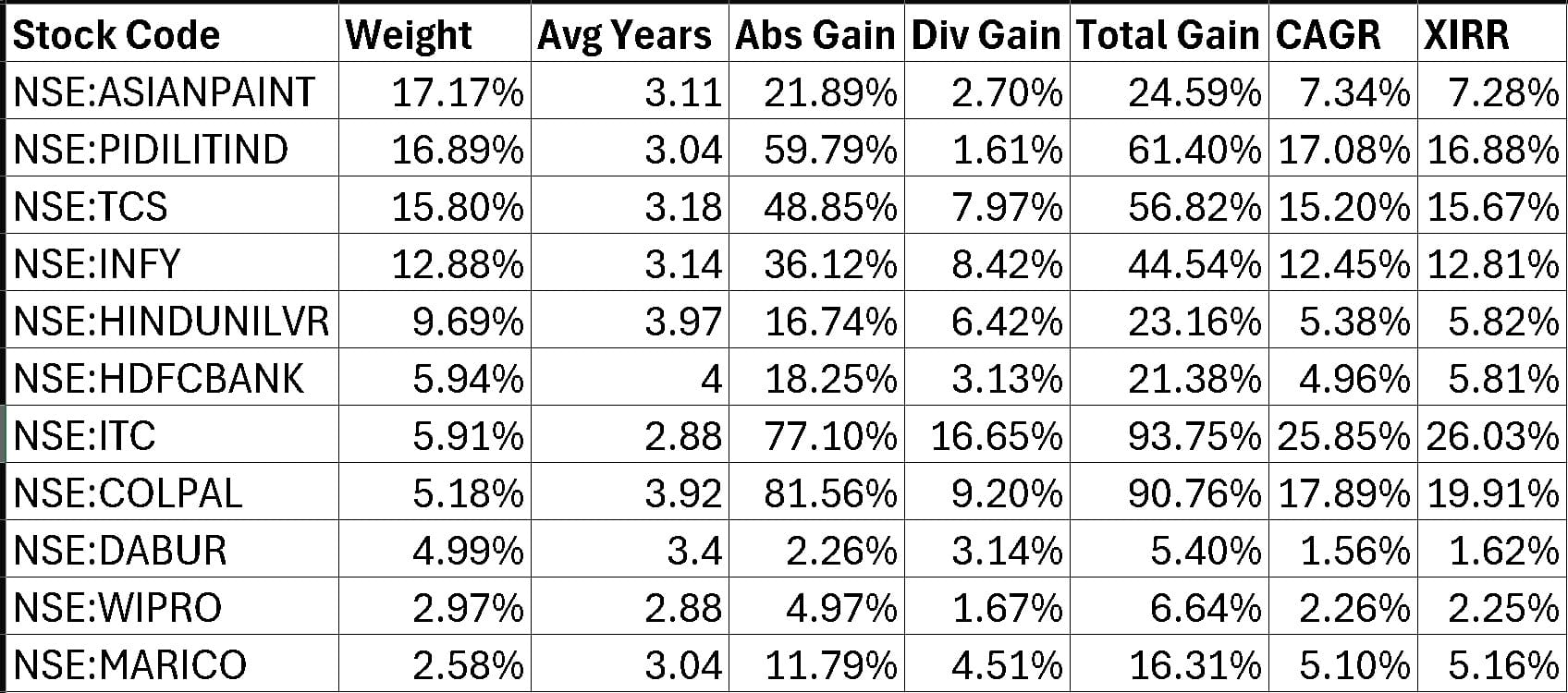

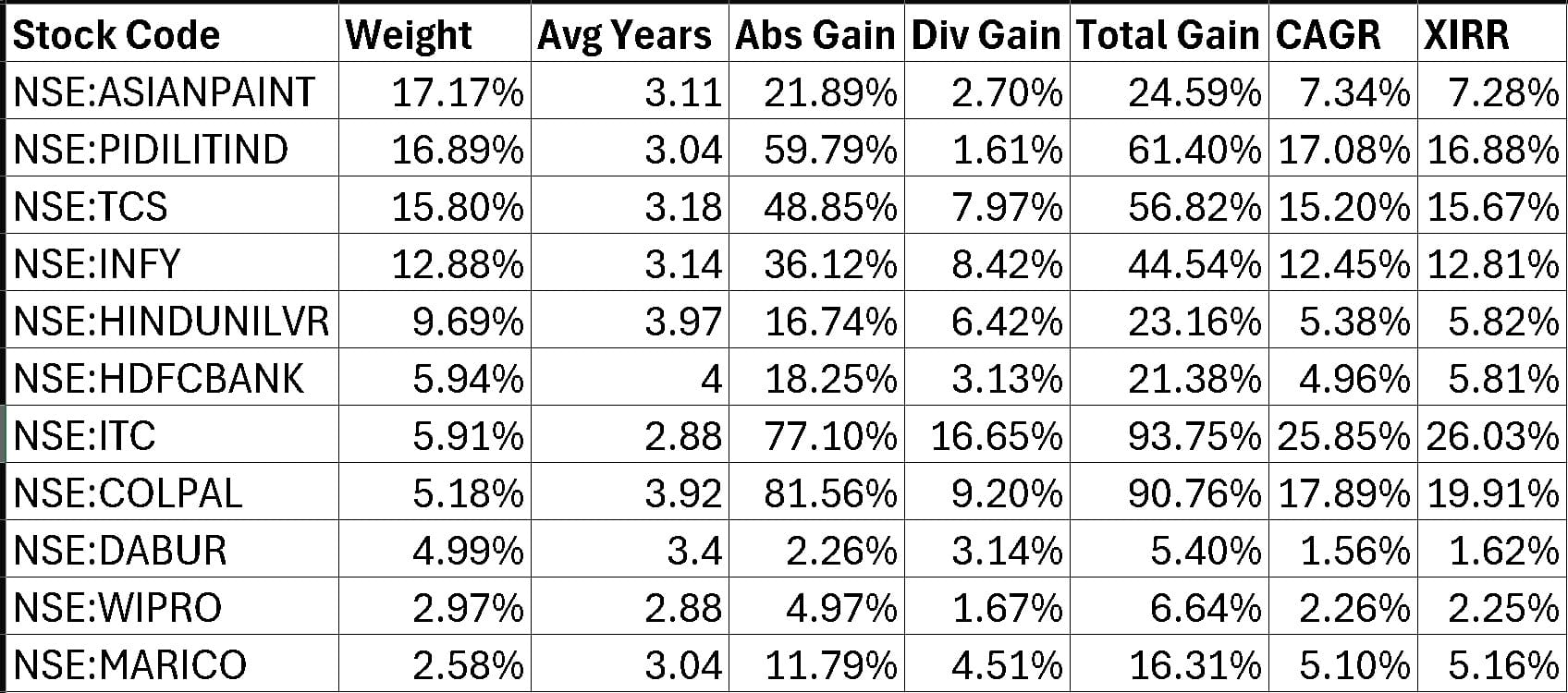

Recap of our earlier suggestions (As on 12 Apr 2024)

Different articles you might like

Publish Views:

577

The post Alpha | KPR Mill Ltd. appeared first on kitko.

]]>The post April 1, 2024 | Mutual Fund Observer appeared first on kitko.

]]>Expensive buddies,

It’s April. I spent a lot of the Easter weekend sporting a t-shirt out to work within the gardens. It was wonderful. Right now, the forecast is for hail. Tomorrow? Snow.

Subsequent week? Oh, I don’t know … dragon fireplace?

And nonetheless, it behooves us to be thankful for what we have now. The world’s most corrosive pressure will not be greed. It’s envy, which is pushed by the sense that what we have now simply isn’t sufficient, and bitterness that others have extra. That’s a theme that Charlie Munger mirrored on repeatedly: “I’ve conquered envy in my very own life. I don’t envy anyone. I don’t give a rattling what another person has. However different individuals are pushed loopy by it.” How loopy? Hmmm … assume Biblically loopy: “If you wish to discuss future implications, quite a lot of what I see now jogs my memory of Sodom and Gomorrah. You get exercise feeding on itself, frenzies of envy and imitation” (2005).

It will definitely even contaminated his sidekick, Warren Buffett: “There isn’t any purpose to take a look at the minuses in life. It might be loopy. We depend our blessings.” (Sure, I do know. Simpler mentioned in case you’re price $90 billion.)

The joyful secret to it’s that the blessings don’t must be giant in an effort to be significant. Jancee Dunn, writing within the New York Occasions “Nicely” publication, mirrored on her anxious day on the Occasions when she couldn’t work out how you can log in to the corporate’s community, was terrified that somebody might overhear her fumbling on the cellphone, and so snuck off to satisfy one of many Wizards within the IT division (Chip assures me that she hires solely wizards-in-training in IT.). Adnan The Wizard mounted her downside, commiserated, and shared a thought:

He informed me to think about a jar and instructed that I add a metaphorical penny to it each time I achieved one thing — even a activity as small as discovering my method again to my desk.

Over time, he mentioned, you’ll replenish the jar. You will notice that you’re transferring ahead, even while you don’t really feel that you’re, he added.

I nonetheless take into consideration that jar, particularly once I’m having a tough time. I nonetheless deposit “pennies.” (“Feeling Overwhelmed? Attempt Tallying Your Tiny Wins,” NYT.com, 3/29/2024)

And so, within the face of hail and uncertainty, I have a good time my blessings: a loving household that I work to deserve, a significant calling and the belief of the households that make it attainable, the sight of a bald eagle spiraling lazily above the tennis courts simply past my window, time with all of you people, and the indicators that nature will give me one other probability this 12 months.

On this month’s Observer

One among my particular blessings is the power to work with people whose understanding of points is profound and sophisticated and whose willingness to translate that understanding to your profit appears boundless. Devesh, having spent knowledgeable lifetime buying and selling billions of {dollars} in choices, completes his Choices Trilogy for you this month. In March 2024, Devesh performed out current traits in choices markets as he examined the virtually manic rush into such funds. This month completes the trilogy with a deeper dive into the workings of choices in 10 funds and a mirrored image on The Choices Conundrum, together with the query of whether or not you may not revenue extra with a Replicant Portfolio: an ultra-low-cost fairness index and T-bills. readers ought to begin with Choices Based mostly Funds – a deeper dive.

Lynn presents two items this month. First, he updates his profile of Constancy New Millennium ETF (FMIL) by noting that … effectively, it’s gone. Constancy launched a set of lively ETFs final month, one in every of which absorbed and remodeled FMIL. Lynn shares his evaluation of the suite on provide. Second, he analyzes the choices of funds for long-term tax-efficient investing and comes up with two suggestions for you.

Lastly, The Shadow brings us updated on small victories for buyers (umm, okay, a bit quick there this month), the business’s new methods for Inexperienced Flight (rename the fund, redescribe the technique, and, failing that, bail out), and we bid farewell to a near-record variety of funds.

My contribution this month facilities on this essay, the place we’ll take a look at the market’s illusory calm, two investments you actually wish to discover, one you may pray to keep away from, and a bunch of iterations on the identical query: greed or envy, happiness or satisfaction?

I’ve two initiatives underway for you that try that can assist you take into consideration methods for coping with unstable markets.

Infrastructure investing: as nationwide governments fail to decelerate the speed of local weather change, sub-national governments are more and more planning huge infrastructure expenditures to mitigate a number of the results on human communities. Infrastructure bills are likely to function in a rhythm impartial of the inventory market, which makes them helpful for diversification. I’ve reached out to groups with three of essentially the most promising funds. To this point, I’ve bought one “we’ll get again to you” and two lifeless silences. (Actually, guys, take down the d**med “media contact” hyperlink in case you’re incapable of even a well mannered “no thanks.”) I’ll proceed these outreach efforts.

High quality investing: “high quality at an affordable worth” displays a exceptional market anomaly. The shares of high-quality corporations are typically underpriced, strong in up-markets, and distinctive in unstable ones. The online impact is increased long-term returns with decrease short-term volatility, which (concept says) shouldn’t occur. And it undoubtedly shouldn’t occur constantly. Nevertheless it does. A straightforward case may be made for the brand new GMO US High quality Fairness ETF; as a matter of reality, we have made it, Chip was satisfied to purchase it, and it has simply outperformed its five-star, $10 billion sibling. We’ve been working with a Morningstar strategist who recognized ten distinctive funds with an emphasis on high quality investing. He shared commentary on every, and we’re nonetheless figuring out an understanding of what’s immediately quotable and attributable.

Slightly than share half-complete initiatives, we’ve moved each to be featured tales in our Could 2024 challenge.

And why, you ask, fear about investments for unstable markets when the present market is eminently secure and rising? (Nicely, besides that the Magnificent Seven have been lowered to the Fabulous 4.)

“Markets have a false sense of safety”

The Wall Road Journal is likely to be channeling their interior Devesh. They observe that there’s been a flood of cash into options-backed funds and ETFs, however the information will not be all good. Jon Sindreu (3/8/2024) writes:

Should you purchased so-called structured merchandise lately, you could have loads of firm. However is exactly their reputation that would make them – and maybe your complete inventory market – riskier than they appear … The discount usually appeals to less-sophisticated buyers who in any other case may not dabble in advanced derivatives. For banks they bring about in fats charges.

There follows a dialogue of 1 class of derivatives referred to as “autocallables.” At base, banks are the counterparties within the autocallable commerce, so that they have the motivation to hope for market stability, which, partly, is attributable to their very own want to purchase “insurance coverage” towards their publicity to those choices. Sindreu summarizes:

So autocallables look engaging as a result of the inventory market is calm, however the market is calm as a result of individuals are shopping for so many autocallables. The suggestions loop is harking back to the one created by funds that immediately wagered towards volatility again in 2017 and 2018. When a bout of promoting broke the cycle, banks stopped hedging, volatility exploded and the market tanked.

His conclusion: you shouldn’t belief the Vix as a gauge of potential hassle. Quoting Jeffrey Yu of BNY Mellon, “Low volatility begets low volatility. Till one thing goes unsuitable.”

Per week later, a second Journal author echoed the warning:

The inventory market is calmer than it has been in years. Some fear {that a} in style technique is contributing to the tranquility.

Measures of market volatility have fallen to ranges final seen in 2018 …

Buyers are looking for safety from potential losses by pouring cash into [covered-call ETFs] … belongings in such funds has topped $67 billion, up from $7 billion on the finish of 2020.

Their argument is that this type of herd commerce (in volatility ETFs) “blew up in spectacular vogue six years in the past.” The choices commerce now exceeds shares in worth, with each covered-call place essentially matched over an reverse place in “name overwrites.” The priority is that this can be a advanced, leveraged construction that is likely to be catastrophically susceptible to an exterior shock that causes a cascading rush to the exits. (See Charley Grant, “In style guess weighs on volatility,” WSJ, 3/26/2024, B1. It’s on-line with a paywall and a barely totally different title.)

Each are good items and remind us that one of the best time to patch the roof is earlier than the rain begins. Our Could options are aimed in that route.

Excellent news, good guys, GoodHaven

Morningstar Journal featured GoodHaven Fund, which we profiled in July 2023 (“The Rise of GoodHaven Fund“), in their March 2024 challenge. Our fast abstract: exceptional turnaround. Distinctive portfolio. Disciplined supervisor.

Morningstar Journal featured GoodHaven Fund, which we profiled in July 2023 (“The Rise of GoodHaven Fund“), in their March 2024 challenge. Our fast abstract: exceptional turnaround. Distinctive portfolio. Disciplined supervisor.

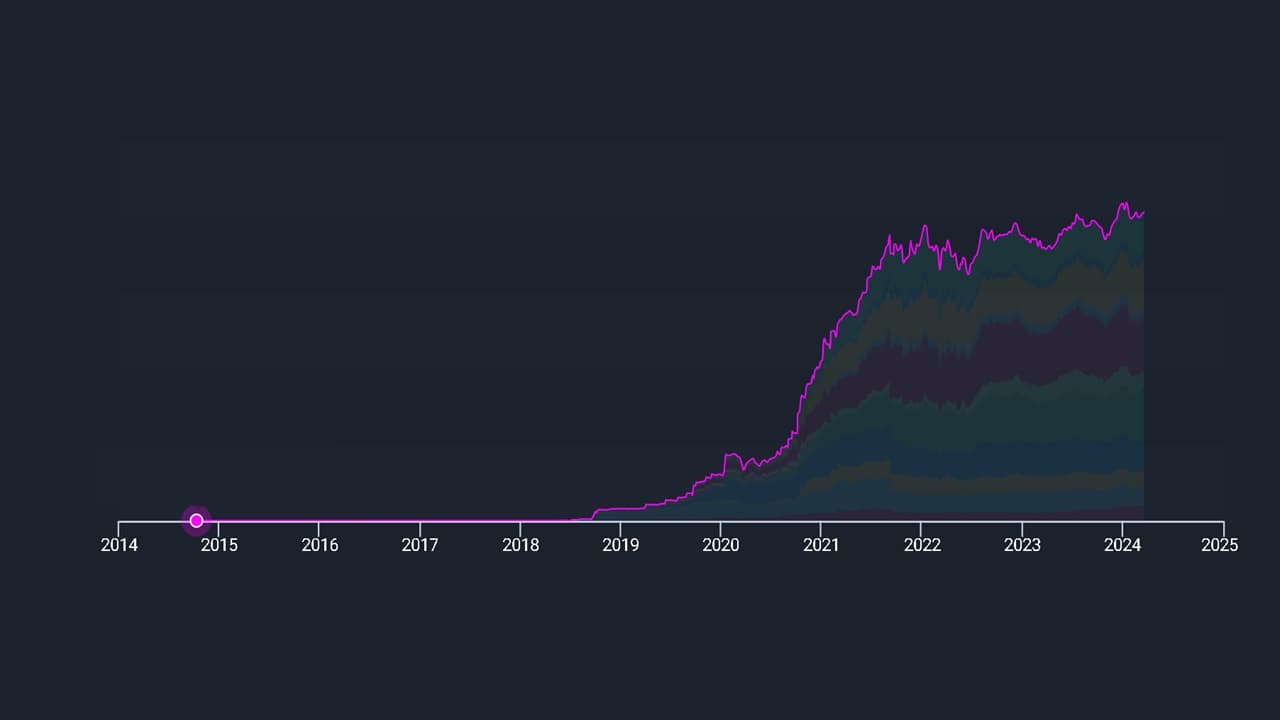

We, they usually, each observe the supervisor’s principled choice to revamp his technique in late 2020. The concept was to focus extra on “particular conditions” provided that they have been demonstrably “particular” and “high quality at an affordable worth” technique moderately than specializing in purely statistical measures of cheapness.

It’s working.

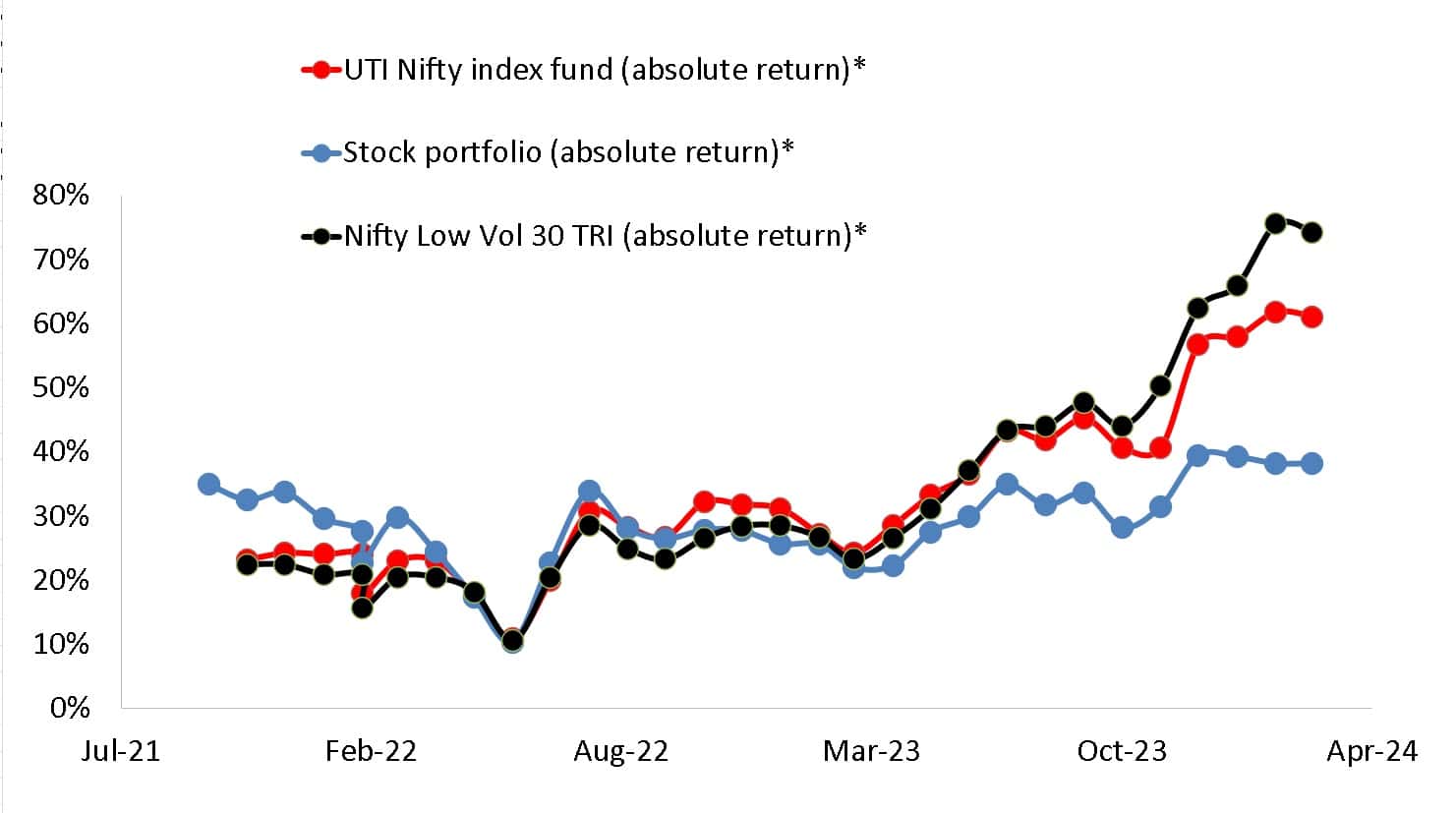

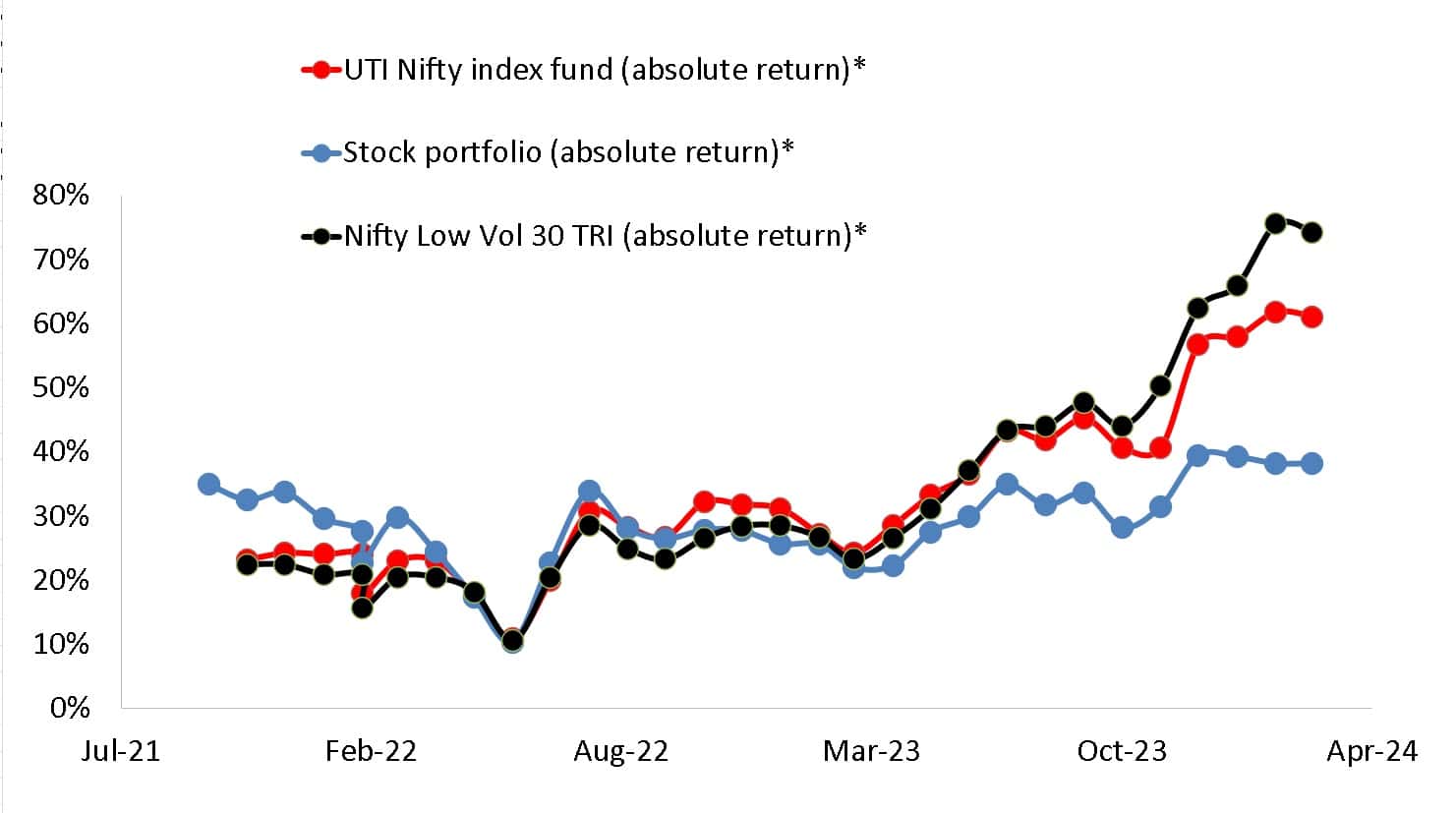

Comparability of 3-Yr Efficiency (April 2021 – March 2024)

| APR | Max drawdown | Draw back deviation | Ulcer Index |

Sharpe Ratio |

Sortino Ratio |

Martin Ratio |

|

| GoodHaven | 17.3% | -17.8 | 10.1 | 6.6 | 0.86 | 1.44 | 2.19 |

| Multi-Cap Worth friends | 8.6 | -18.0 | 10.8 | 6.4 | 0.35 | 0.55 | 1.06 |

| S&P 500 | 11.5 | -23.9 | 11.6 | 10.0 | 0.50 | 0.75 | 0.88 |

Supply: MFO Premium fund screener and Lipper World knowledge feed

Methods to learn that?

Returns: APR means the annual proportion return for the interval

Dangers: the utmost drawdown and draw back deviation (referred to as “dangerous deviation”) measure draw back volatility for the interval. In these circumstances, decrease is best.

Threat-return stability: the Ulcer Index measures how far an funding falls and the way lengthy it takes to rebound. Smaller (as in “it gave me a smaller ulcer”) is best. The Sharpe, Sortino, and Martin ratios assess an funding’s returns towards an more and more excessive risk-management bar; that’s, Martin is rather more risk-averse than Sharpe. In every case, increased is best.

By these measures, GoodHaven has been a uniform and constant winner. Morningstar frets that the fund “might not have broad attraction” as a result of it doesn’t match neatly right into a field. So I assume in case you care about bins, you may flip to The Container Retailer. Should you care extra about efficiency, you may add GoodHaven to your due diligence checklist.

Microcap fairness funds price consideration

I contributed, in partnership with Mark Gill, to a chunk entitled “Microcap Funds” within the March 6, 2024 challenge of Backside Line. Backside Line is a type of cool “a little bit of this and a little bit of that” publication that covers private subjects from finance to diet and scholarship sources. I contribute sometimes. Mark and his editors assess reader curiosity in numerous subjects, and one of many writers reaches out to speak with me. We speak. I share ideas and knowledge. He drafts, I revise.

The premise is that microcaps are profoundly undervalued relative to a bunch of measures and have a tendency to carry out exceptionally effectively when rates of interest start to fall since that usually indicators a interval of financial acceleration. The MFO Premium screens recognized about ten choices, and Mark picked up on three.

With a bit more room, I’d have urged him – and also you – to research Pinnacle Worth (PVFIX), which is a five-star fund managed by John E. Deysher. The fund embodies a low turnover, absolute worth technique that permits the supervisor to carry substantial money when compelling alternatives are few.

With a bit more room, I’d have urged him – and also you – to research Pinnacle Worth (PVFIX), which is a five-star fund managed by John E. Deysher. The fund embodies a low turnover, absolute worth technique that permits the supervisor to carry substantial money when compelling alternatives are few.

Shallow observers will say, “he’s been within the backside 10% of his peer group 4 occasions within the final ten years.” Those that look nearer may observe that John’s market cap is one-twentieth of his peer group’s, and he’s posted double-digit absolute returns in three of these 4 years. 2017 is the one truly dangerous 12 months. In each interval we observe – whether or not 3/5/10 12 months home windows or market cycles – Pinnacle’s Sharpe ratio ranges from “a lot increased” than its friends (50% increased since inception) to “ridiculously increased” (400% increased over the previous three years). The fund’s customary deviation is half of the group’s.

One measure of the success of an absolute worth technique is the fund’s huge outperformance, measured in APR or annualized proportion charges, throughout the current bear markets.

| 2007-09 GFC | 2020 Covid bear | 2022 bear | Full cycle – 2022 bear + subsequent bull | |

| Pinnacle Worth | -24.8% | -23.3 | -7.7 | 12.5 |

| Small worth common | -53.6 | -38.0 | -18.0 | 4.7 |

John manages about $34 million in belongings, barely above the place he was in 2015 after we profiled the fund. Our conclusion, then and now, is identical:

Mr. Deysher would favor to provide his buyers the chance to earn prudent returns, sleep effectively at night time, and, ultimately, revenue richly from the irrational conduct of the mass of buyers. Over the previous decade, he’s pulled that off higher than any of his friends (2015).

“Irrational conduct of the mass of buyers”? The place have I heard that earlier than? Hmmm…

John is a laconic soul, so studying his 2023 Annual Report takes modestly much less time than ending your morning cup of espresso.

Trump in your portfolio

Extra appropriately, Trump Media (DJT). Mr. Trump’s firm, previously Fact Social, is now publicly traded on the Nasdaq alternate. Over the week previous April 1, 2024, it had a share worth of between $43-73, giving it a considerably unstable market cap. Its peak capitalization was $8 billion. It spent a lot of the final week of March at round $7 billion and started April at $5.5 billion. By way of market cap, that’s within the neighborhoods of Etsy, Hasbro, Voya, or Invesco. About 5,000,000 shares a day have been buying and selling fingers. In 2023, the corporate had gross sales of $4 million (giving it a worth/gross sales ratio of 1200) and misplaced $58 million (giving it a detrimental p/e ratio of minus 70). By comparability, the median annual gross sales of a McDonald’s location in 2020 was $2,908,000.

As a result of accounting is magical, the firm reported a $50.5 million revenue in 2022 on $1.5 million in income.

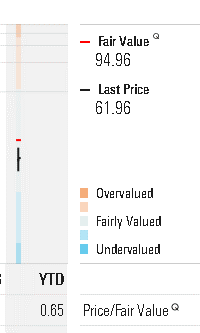

As a result of computer systems are magical, Morningstar’s algorithms have calculated a good market worth for DJT at $94.96 (as of April 1, 2024).

Not , you say?

You may not have a alternative. The itemizing standards for shares within the Russell 3000 index are:

- Itemizing on a US inventory alternate

- A share worth above $1.00 on a rating day on the finish of Could

- A market cap above $30 million

- A free market float of greater than 5% (that’s, greater than 5% of the corporate’s complete shares have to be buying and selling on the open market)

We have now reached out to FTSE Russell, a part of the London Inventory Alternate Group, to know their inclusion course of however haven’t but obtained a response.

Skilled athletes and the economics of envy

There’s been a lamentable lot of commentary these days about Nationwide Soccer League gamers on $40 million/12 months contracts who deserve $60 million contracts. Their insistence on holding out for these previous couple of tens of millions displays the truth that “they gotta maintain their households.”

Actually?

The typical American “takes care of their household” on $51,480 a 12 months. (The Census stories family moderately than particular person incomes; the median there’s $75,000 in 2022.) Loves them, hugs them, goes to their Little League video games and piano recitals, cleans up their messes, and binds their wounds, psychic and bodily. A 2014 examine by the Georgetown Middle on Schooling and the Workforce concluded, “General, the median lifetime earnings for all staff are $1.7 million,” with considerably increased payouts for people with a BA ($2.3M), MA ($2.7M), PhD ($3.2M, and actually I’ve bought to search out somebody to sue over the hole between me and what I’m apparently owed) and MD/JD ($3.6M).

I’m, as lots of you already know, a child from Pittsburgh. In 1977, within the midst of a span through which the Steelers gained 4 Tremendous Bowls, future Corridor of Fame gamers Joe Greene and Lynn Swann made $60,000 / 12 months, roughly four-and-a-half occasions the common earnings for all People that 12 months. After all, they performed for a man, Artwork Rooney Sr., who walked to work each morning. In 2024 phrases, a future Corridor of Fame participant making 4 and a half occasions the common earnings could be hauling in a cool $230,000 a 12 months!

In actuality, $40 million contracts replicate that you just and I are rather more all for watching sports activities occasions than in collaborating – a parent-coach, sponsor, ref, athlete – in a single. Our rapt consideration to their fantasy world underwrites huge contracts and, sometimes, delusional conduct. You may not be extra completely satisfied getting out to the (native) ballfield, however on the finish of the day, you may end up moderately extra happy. Which cues …

In memoriam … Daniel Kahneman (March 5, 1934 – March 27, 2024)

Dr. Kahneman handed away on the age of 90 after a life effectively and absolutely lived. He was acknowledged by The Economist because the world’s seventh most influential economist. That’s placing as a result of (a) our fetish for meaningless rankings makes me smile, and (b) he wasn’t an economist.

Dr. Kahneman handed away on the age of 90 after a life effectively and absolutely lived. He was acknowledged by The Economist because the world’s seventh most influential economist. That’s placing as a result of (a) our fetish for meaningless rankings makes me smile, and (b) he wasn’t an economist.

By “wasn’t an economist,” I imply “by no means even took a single Econ course in faculty.”

Kahneman was a professor of psychology whose work, together with Amos Tversky, laid the premise for the disciplines of behavioral economics and behavioral finance. His elementary achievement was to categorize the constant patterns of cognitive weirdness; others then discovered methods to make uncounted billions by exploiting these patterns. His guide Considering: Quick and Sluggish (2011) comprises findings central to my instructing on propaganda and mass manipulation, however it’s additionally central to the curriculum of enterprise packages throughout the nation. Dr. Kahneman obtained the Nobel Prize in 2002, the Presidential Medal of Freedom in 2013, two dozen honorary doctorates, and numerous skilled awards, together with the Leontief Prize for contributions that “help simply and sustainable societies.”

His less-known work on happiness and satisfaction aligns with my opening reflections on this letter. Kahneman and colleagues did moderately quite a lot of work on the topic, solely to find that most individuals don’t need to be completely satisfied. They wish to be happy. Happiness, he concluded, was the fleeting sensation of pleasure in a specific second. It was evanescent. Satisfaction, he argued, “is a long-term feeling, constructed over time and based mostly on attaining objectives and constructing the type of life you admire.”

Charlie Munger would, I feel, perceive. Stepping by means of the doorway of your million-dollar dwelling and basking within the awe of your mates may make you cheerful. Dwelling in an unassuming dwelling and spending a part of every week constructing shelters for others – as Lynn Bolin does and Jimmy Carter did – is likely to be a surer highway to satisfaction.

Thanks!

Due to Tom & Mes from TN, our previous good friend Gary in PA (I’ll share a bit extra in Could, however I’m very assured this will probably be an amazing 12 months), and John of Honolulu.

To our devoted subscribers: Wilson, Gregory, William, William, Stephen, Brian, David, and Doug. The month-to-month reminders of your help imply quite a bit.

Within the Could Observer, I look ahead to the case for infrastructure funds, high quality investing, two fixed-income choices, and common merriment. We hope to see you there!

The post April 1, 2024 | Mutual Fund Observer appeared first on kitko.

]]>The post The place to take a position for retirement? appeared first on kitko.

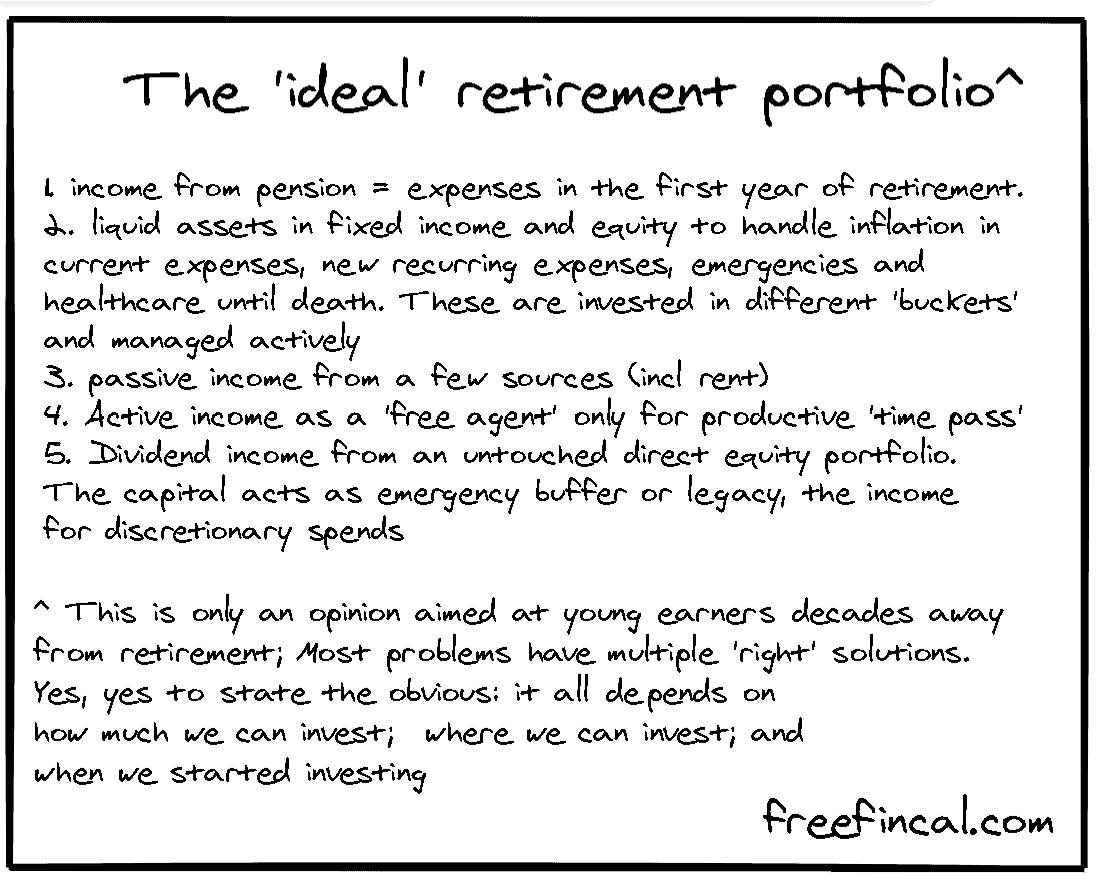

]]>NPS is a retirement product. Particularly focused to build up funds for retirement.

Right here is how NPS can assist you accumulate funds for retirement.

- You accumulate cash till you retire.

- You withdraw from the corpus after you retire.

- You’ll be able to make investments your cash in a diversified portfolio of fairness and debt.

- You’ll be able to withdraw a portion lumpsum and use the remainder the acquisition an annuity plan. The annuity plan can offer you an revenue stream throughout retirement.

However you are able to do all of the above (and extra) with mutual funds too, proper?

- You’ll be able to spend money on MFs when you are working.

- You can begin withdrawing from MFs when you retire.

- You’ll be able to take publicity to completely different property by means of mutual funds too.

- And no one stops you from shopping for an annuity plan utilizing your MF portfolio everytime you need.

Each NPS and mutual funds are market-linked merchandise. Your cash is managed by skilled cash managers and your returns will rely on the efficiency of your funds.

In that case, which is a greater automobile to build up your retirement corpus? NPS or mutual funds?

On this put up, allow us to evaluate NPS and mutual funds on numerous elements and think about numerous nuances of those investments.

Notice: NPS and mutual funds are NOT solely investments for retirement. There are numerous others too and such investments might be a part of your retirement portfolio too. Nonetheless, on this put up, we restrict the evaluation to NPS and mutual funds.

#1 NPS vs Mutual funds: Sort of funding

Each are market linked investments.

No assure of returns.

With NPS, you’ll be able to cut up your cash throughout Fairness Fund (E), Authorities bonds (G), and Company Bonds (C). There may be Asset Class A too, the place you get publicity to various property like REITs, INVITs, AIFs, and so on.

You’ll be able to choose Energetic selection, the place you determine the allocation to numerous asset courses or funds (E,C,G A). Most fairness allocation might be 75%. Most allocation to A might be 5%.

OR

You’ll be able to go for Auto-choice. Select from 3 life cycle funds (Aggressive, Reasonable, Conservative). Within the lifecycle funds, the allocation to E, C, and G funds is pre-defined as per a matrix, and the danger within the portfolio (publicity to E) goes down with age. Portfolio rebalancing additionally occurs robotically within the auto-choice lifecycle funds.

With mutual funds, there is no such thing as a dearth of selection. You will have a number of forms of fairness and debt funds. You’ll be able to make investments even in gold, silver, and even international equities. You’ll be able to determine asset allocation and select funds freely.

#2 NPS vs Mutual Funds: Exit Guidelines

NPS is sort of strict right here. Anticipated too from a retirement product.

In NPS, you can’t exit earlier than attaining the age of 60. Therefore, your cash is nearly locked in till the age of 60.

Level to Notice: There isn’t any requirement that you have to exit NPS if you flip 60. The NPS guidelines assist you to defer the exit from NPS till the age of 75.

On the time of exit, you’ll be able to withdraw as much as 60% of the amassed corpus as lumpsum. It’s essential to make the most of the remaining 40% to buy an annuity plan. Nonetheless, if you want, you’ll be able to even make the most of your complete quantity to buy an annuity plan. 0-60% lumpsum withdrawal. 40-100% annuity buy.

Sure, you’ll be able to exit NPS prematurely too when you full 10 years. Nonetheless, for pre-mature exit, you have to use 80% of the amassed corpus to buy an annuity plan. Solely 20% might be taken out lumpsum. NPS additionally permits partial withdrawals in sure conditions.

With mutual funds, there is no such thing as a restriction on exit from any scheme. You’ll be able to promote everytime you need. The one exception is ELSS the place your funding is locked in for 3 years from the date of funding.

In case of NPS, annuity buy will occur with pre-tax cash.

You should purchase annuity plans utilizing your MF proceeds too. Nonetheless, please perceive, in case of mutual funds, annuity buy will occur with post-tax cash. You’ll promote your mutual funds to purchase an annuity plan and sale of MFs will lead to capital positive factors legal responsibility.

#3 NPS vs Mutual Funds: Tax-Therapy on Funding

Personal Contribution to NPS account

If you’re submitting ITR underneath Previous tax regime, you’re going to get tax profit underneath Part 80CCD(1B) for as much as Rs 50,000 per monetary yr for funding in Tier-1 NPS. This tax profit is offered over and above tax advantage of Rs 1.5 lacs underneath Part 80C.

Profit underneath Part 80CCD(1B) not out there underneath New Tax Regime.

Employer contribution to NPS account

That is relevant to solely salaried staff. And even there, not all employers supply this. Nonetheless, in case your employer presents NPS, it can save you some critical tax in case your employer presents to contribute to your NPS account.

Employer contribution to your NPS, EPF, and superannuation account is exempt from tax upto Rs 7.5 lacs each year. For NPS, this tax exemption has a further cap. Such a contribution should not exceed 10% of primary wage. The cap will increase to 14% for state and central Authorities staff.

On this put up, each time I check with NPS, I imply Tier-1 NPS. There may be NPS-Tier 2 as nicely and you will get tax-benefit for funding in Tier-2 NPS topic to circumstances. Nonetheless, I’ve not thought-about Tier-2 NPS right here as a result of it isn’t a pure retirement product. Moreover, I’m referring to All Residents Mannequin or Company NPS mannequin.

In case of mutual funds, there is no such thing as a tax profit on funding, apart from ELSS. Funding in ELSS qualifies for tax profit underneath Part 80C of the Revenue Tax Act.

#4 NPS vs Mutual Funds: Tax Therapy on Exit

NPS: On the time of exit, any lumpsum withdrawal (as much as 60% of the amassed corpus) is exempt from revenue tax.

Remaining quantity (40%) should be used to buy an annuity plan. Whereas this quantity used to buy annuity plan shouldn’t be taxed, the payout from an annuity plan is added to your revenue and taxed at your slab fee.

Mutual fund taxation depends upon the kind of mutual fund and the underlying home fairness publicity.

#5 NPS vs Mutual Funds: NPS permits tax-free rebalancing

NPS wins this contest simply. Tax-free rebalancing is the most important optimistic of NPS.

In NPS, taxes come into image solely on the time of exit from NPS. Not earlier than that. Therefore, your cash can compound unhindered by the friction of taxes.

Switching cash between several types of funds and even switching to a distinct pension fund supervisor doesn’t lead to any capital positive factors. Therefore, no capital positive factors taxes.

This makes portfolio rebalancing tremendous tax-efficient.

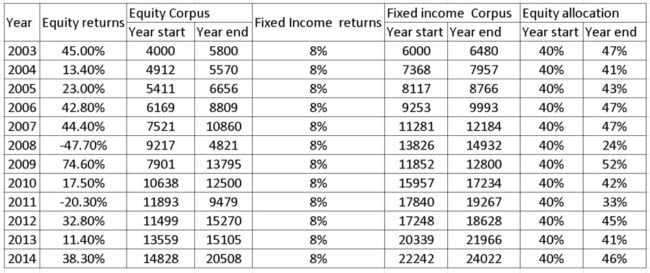

So, allow us to say your NPS portfolio is 50 lacs. Energetic-choice NPS.

Rs 30 lacs in E and a cumulative 20 lacs in E and G.

Your goal allocation is 50:50 Fairness: debt but it surely has gone to 60:40 fairness: debt due to the inventory market run-up. You’ll be able to merely tweak your allocation to E:C: G barely (to say 51:25:24) and the portfolio will rebalance to your goal degree (fairly near that). You’ll not must pay any taxes throughout rebalancing in NPS.

In Auto-choice NPS, rebalancing occurs robotically in your birthday. In Energetic selection, you have to do that manually.

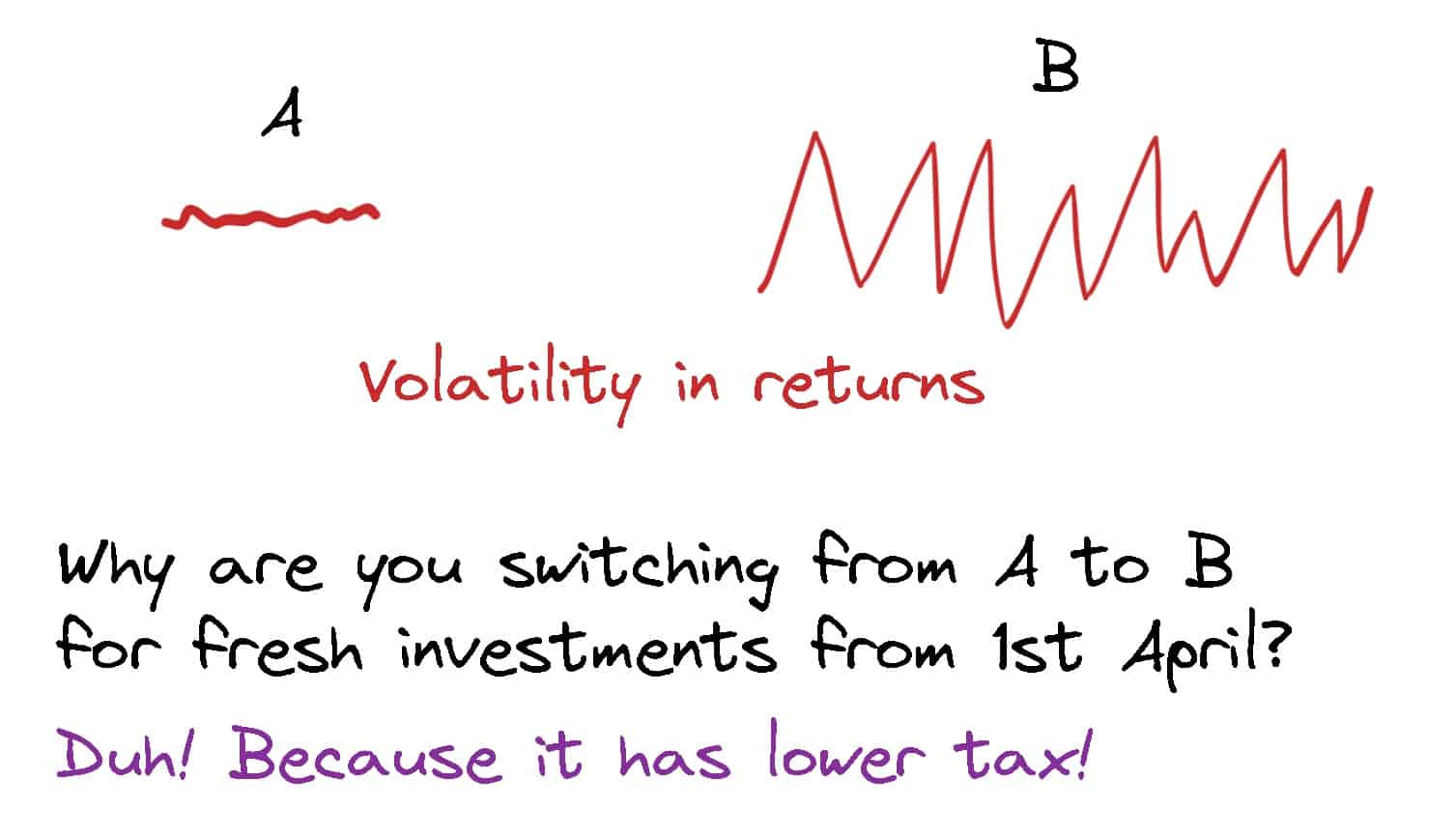

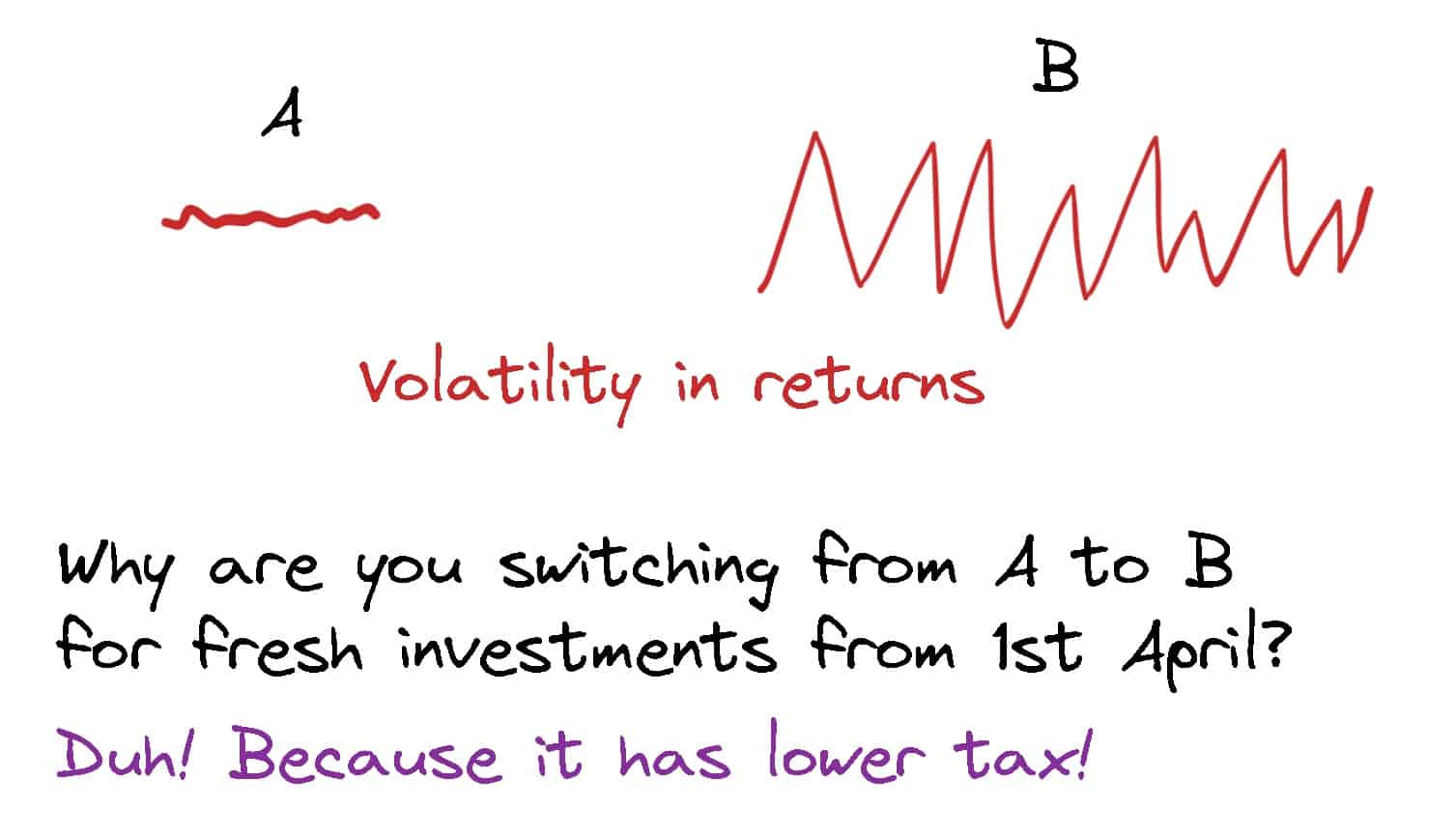

That is vital contemplating the taxation of mutual fund investments has turn out to be more and more opposed over the previous decade.

2015: Lengthy-term holding interval for debt funds was elevated from 1 yr to three years. Not as a lot of an issue.

2018: Lengthy-term capital positive factors tax introduced in for fairness funds. Any LTCG on sale of shares/fairness MF greater than Rs 1 lac in a monetary yr taxed at 10%.

2023: Idea of long-term capital positive factors faraway from debt funds. For debt MF items purchased after March 31, 2023, all capital positive factors arising out of sale of such items shall be thought-about brief time period positive factors and be taxed at revenue tax slab fee (marginal tax fee). That is the most important drawback.

Clearly, in the event you should rebalance a portfolio of mutual funds, there might be leakage within the type of taxes. This can hinder compounding. Furthermore, it isn’t nearly rebalancing. You will have invested in a mutual fund that you don’t like as a lot anymore. In absence of taxes, you’ll merely change to the mutual fund that you just like extra. Nonetheless, taxes make this whole train tough.

For rebalancing, there’s a small workaround that you need to use in some instances. As an alternative of shuffling outdated investments, tweak the incremental allocation. For example, allow us to say your goal fairness: debt allocation is 50:50. Due to the current market fall, the asset allocation is now 45:55 fairness: debt. You’ll be able to route all incremental cashflows to fairness funds till the asset allocation shifts again to focus on allocation. Since you aren’t promoting something there is no such thing as a drawback of taxes. Personally, I discover this a lot strategy a bit cumbersome and tough to execute. This strategy will anyhow not work for greater portfolios.

#6 NPS vs Mutual Funds: Early retirement is usually a drawback

What in the event you determine to retire on the age of 55 and never 60?

NPS is inflexible. Retirement means 60 and above.

Therefore, in the event you go for an early retirement and most of your retirement cash is in NPS, you’ve an issue.

Should you exit on the age of 55, then you have to use 80% of the amassed corpus in direction of buy of an annuity plan.

Notice that NPS account doesn’t must closed if you cease working. You’ll be able to proceed the account even past your retirement. Therefore, even in the event you had been to retire at 55, you’ll be able to proceed and even contribute to your NPS account till the age of 60,70, or 75.

With mutual funds, you’ll NOT face this drawback. You’ll be able to take out your cash everytime you need. Withdrawals will not be linked to your age.

On a aspect notice, whereas NPS could path MFs in flexibility, it’s far forward of different pension merchandise.

I’m evaluating NPS to pension merchandise from life insurance coverage corporations in India. Life insurance coverage corporations have launched pension merchandise in each linked and non-linked variants.

In NPS, your investments do not need to be systematic. You’ll be able to even make large lumpsum investments. No limits. With different pension merchandise, you have to pay a certain quantity of premium yearly. Topping up shouldn’t be simple.

Proceeds from ULIPs (with annual premium > 2.5 lacs) and Conventional plans (with annual premium > 5 lacs) are actually taxable. No such drawback with NPS.

In NPS, you’ll be able to withdraw 60% of amassed corpus tax-free. In pension plans from insurance coverage corporations, you’ll be able to withdraw just one/3rd of accumulate corpus tax-free.

#7 NPS vs Mutual Funds: NPS has lesser selection

You’ll be able to spend money on just one fairness fund underneath NPS. Likewise for C and G funds.

Whereas your Fairness(E), Authorities bonds (G), and Company Bonds (C) might be from completely different pension fund managers, you continue to have simply 1 fairness fund in your NPS portfolio. 1 actively managed fairness fund. I’d anticipate these fairness funds from NPS to have a large-cap tilt.

Every Pension fund supervisor (PFM) presents 1 E, 1 G, and 1 C fund. You’ll be able to spend money on just one E, G, and C funds. From the identical or completely different PFMs. You can not spend money on 2 fairness funds. Or fairness funds from 2 pension fund managers.

Mutual funds supply a a lot wider number of decisions. You will have giant cap, midcap, and small cap funds. Each energetic and passive. Flexicap, Issue, Sectoral, Thematic. International fairness. You title it and you’ve got it.

Relating to investments, much less selection shouldn’t be essentially dangerous. Nonetheless, most buyers wouldn’t need to hold all their fairness cash in a single actively managed fund, as is the case in NPS.

#8 NPS vs Mutual Funds: Returns

I don’t need to evaluate returns. Just because NPS funds have a lot lesser restrictions on the place they will make investments. What must be the true benchmark for an NPS Fairness fund? Nifty 50, Nifty 100, Nifty 500? Which fairness mutual funds ought to I evaluate the efficiency with?

You’ll be able to test the returns of varied NPS schemes right here.

#9 NPS vs Mutual Funds: Prices

NPS is the bottom value funding product. The Funding administration charge is lower than 10 bps.

Mutual funds bills are a lot greater. Is dependent upon a number of elements. Common or Direct. Fairness or Debt. Energetic or Passive.

#10 NPS vs Mutual Funds: Is necessary annuity buy an issue?

With an annuity plan, you pay a lump sum to the insurance coverage firm. And the insurance coverage firm ensures you an revenue stream for all times.

Obligatory annuity buy has been highlighted a serious drawback of NPS.

Nonetheless, I don’t see necessary annuity buy as an issue. Any good retirement product ought to have the ability to divert an allocation in direction of annuity buy. Nonetheless, you have to purchase the correct variant on the proper age.

Sure, if you’re good with cash, you’ll be able to handle with out an annuity plan. Nonetheless, most buyers would wrestle to generate common cashflows throughout retirement from a market linked portfolio. If payouts from an annuity plan can cowl a portion of your bills, I don’t see a lot drawback there.

Even if you’re good, you have to think about following factors.

- With annuity plans, you’ll be able to lock-in rate of interest for all times. No different product can do that. Sure, there are long run Authorities Bonds with maturity of as much as 40 years. Nonetheless not for all times. Solely annuity merchandise can. What if

- Covers longevity threat. The revenue will proceed for all times. Even when the quantity is small, you’ll by no means run out of cash. Should buy variants the place your partner will obtain cash after you. These are sensible life conditions that must be offered for. Not everybody within the household can handle withdrawals from a diversified portfolio.

- By staggering annuity purchases can improve revenue and scale back threat within the portfolio. By making certain a primary degree of revenue, you’ll be able to take greater threat (commensurate along with your threat profile) along with your remaining investments and probably earn higher returns.

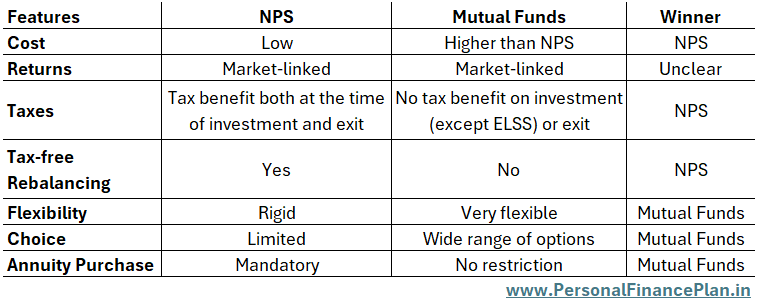

It isn’t an either-or resolution

A fast comparability on all of the elements we mentioned above.

- Value: NPS wins right here.

- Returns: Each are market-linked. I favor NOT to match returns.

- Taxes: NPS wins right here, each in tax profit on funding and tax therapy on the time of exit.

- Flexibility: Mutual funds win right here. No lock-ins. Straightforward withdrawals. Exit not linked to age. NPS is inflexible.

- Selection: Mutual funds are a transparent winner. Far larger selection of funds in comparison with NPS.

- Obligatory Annuity Buy: NPS has this restriction. Mutual funds don’t. I don’t see necessary annuity buy as an issue. With mutual funds too, you should buy an annuity plan.

Notice: In case of NPS, annuity buy will occur with pre-tax cash. In case of mutual funds, annuity buy will occur with post-tax cash.

So, which is a greater funding automobile for retirement financial savings? MFs or NPS?

I don’t suppose we’ve an goal winner right here. NPS fares higher on value, taxes, and a important space of portfolio administration, portfolio rebalancing. MF is an outright winner in flexibility and selection of funds. Therefore, the reply depends upon your necessities and preferences.

Furthermore, it isn’t an either-or resolution. You should use each.

When you find yourself planning for retirement, you do not need to maintain all of your retirement cash in a single automobile. You should use a number of automobiles for a similar objective.

Therefore, you’ll be able to spend money on each mutual funds and NPS on your retirement.

If the inflexible exit guidelines or the dearth of selection of funds in NPS worries you, you’ll be able to make investments extra in mutual funds.

If tax-free rebalancing is a excessive precedence, you’ll be able to allocate a sizeable quantity in NPS.

Sure, you’ll be able to produce other merchandise too in your portfolio equivalent to EPF, PPF, Gold, bonds and so on). For this put up, I’m limiting dialogue to MFs and NPS.

An instance of how one can profit from tax-free rebalancing characteristic of NPS.

Allow us to say, on your retirement portfolio, you’ve Rs 40 lacs in NPS and Rs 40 lacs in mutual funds.

NPS: E: 24 lacs, G: 8 lacs C: 8 lacs

Mutual funds: Fairness Funds: 28 lacs, debt funds: 12 lacs

Whole fairness allocation = 24 + 28 = Rs 52 lacs, which is 65% allocation to equities.

However you needed 60:40.

Should you promote fairness funds and purchase debt funds, you’ll have to pay tax.

Alternatively, in the event you may shift Rs 4 lacs from NPS-Fairness (E) fund to G and C funds, we are able to go to again to 60:40 goal allocation with out paying any taxes. And you are able to do that by merely altering asset allocation in NPS to 50:25:25 (E:G:C).

Personally, I favor to have the majority of the cash in mutual funds. Larger selection of funds. Availability of passive investments. Higher disclosures than NPS funds. Extra centered regulator (SEBI vs. PFRDA). On the identical time, having an honest allocation to NPS wouldn’t hurt due to the tax-free rebalancing characteristic. In actual fact, the allocation to NPS can come in useful since you should purchase an annuity plan from pre-tax cash after you retire.

What do YOU favor on your retirement financial savings: NPS or Mutual funds?

Picture Credit score: Unsplash

Disclaimer: Registration granted by SEBI, membership of BASL, and certification from NISM on no account assure efficiency of the middleman or present any assurance of returns to buyers. Funding in securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing.

This put up is for schooling function alone and is NOT funding recommendation. This isn’t a advice to take a position or NOT spend money on any product. The securities, devices, or indices quoted are for illustration solely and will not be recommendatory. My views could also be biased, and I’ll select to not deal with elements that you just think about vital. Your monetary objectives could also be completely different. You will have a distinct threat profile. Chances are you’ll be in a distinct life stage than I’m in. Therefore, you have to NOT base your funding choices based mostly on my writings. There isn’t any one-size-fits-all resolution in investments. What could also be a great funding for sure buyers could NOT be good for others. And vice versa. Subsequently, learn and perceive the product phrases and circumstances and think about your threat profile, necessities, and suitability earlier than investing in any funding product or following an funding strategy.

The post The place to take a position for retirement? appeared first on kitko.

]]>The post Lively Mutual Funds Outperformance Consistency Report (March 2024) appeared first on kitko.

]]>This text presents an outperformance consistency report of lively mutual funds. This evaluation was achieved for a SEBI-sponsored discuss given to Tamil Nadu Buyers Affiliation Members on March twenty fourth, 2024.

Disclaimer: Fund efficiency experiences current return and danger evaluation of a fund with consultant benchmarks and never funding suggestions. It have to be expressly understood that the info beneath replicate solely previous efficiency and is under no circumstances a sign of future efficiency.

Rolling return outperformance consistency (aka efficiency consistency): Lively fund returns are in contrast with class benchmark returns over each potential 5Y and 10Y interval from Apr 2006 to March 2024. The upper the outperformance consistency, the higher. Suppose 876 fund returns have been in contrast with 876 benchmark returns, and the fund has crushed the benchmark 675 occasions. The consistency rating will probably be 675/876 ~ 0.77 or 77%. A rating of 1 means 100%.

Classes research with benchmarks used

| Class | Benchmark |

| Aggressive Hybrid Fund | Crisil6535 |

| Contra | Nifty 100 TRI |

| Dividend Yield | Nifty 100 TRI |

| Fairness Linked Financial savings Scheme | Nifty 200TRI |

| Flexi Cap Fund | Nifty 200TRI |

| Centered Fund | Nifty 200TRI |

| Massive & Mid Cap | Nifty 200TRI |

| Massive Cap Fund | Nifty 100 TRI |

| Mid Cap Fund | NiftyMidcap150TRI |

| Multi Cap Fund | Nifty 200TRI |

| Sectoral/ Thematic | Nifty 100 TRI |

| Sectoral/ Thematic (worldwide) | Nifty 100 TRI |

| Small cap Fund | NiftyMidcap150TRI |

| Worth Fund | Nifty 100 TRI |

Clarification:

Total: 10-year intervals; Common Plan Funds vs Class benchmarks

- 168 funds throughout all classes with not less than 500 10-year knowledge factors

- 78 funds (46%) with a efficiency consistency of 70% or extra

- 87 funds (52%) with a efficiency consistency of 60% or extra

Total: 5-year intervals; Direct Plan Funds vs Class benchmarks

- 277 funds throughout all classes with not less than 500 5-year knowledge factors

- 96 funds (35%) with a efficiency consistency of 70% or extra

- 123 funds (44%) with a efficiency consistency of 60% or extra

Mid cap funds:

5-year intervals; Direct Plan Funds vs Nifty Midcap 150 TRI

- 22 funds throughout all classes with not less than 500 5-year knowledge factors

- 4 funds (18%) with a efficiency consistency of 70% or extra

- 7 funds (32%) with a efficiency consistency of 60% or extra

10-year intervals; Direct Plan Funds vs Nifty Midcap 150 TRI

- 14 funds throughout all classes with not less than 500 5-year knowledge factors

- 5 funds (36%) with a efficiency consistency of 70% or extra

- 7 funds (50%) with a efficiency consistency of 60% or extra

Small cap funds:

5-year intervals; Direct Plan Funds vs Nifty Midcap 150 TRI

- 14 funds throughout all classes with not less than 500 5-year knowledge factors

- 6 funds (43%) with a efficiency consistency of 70% or extra

- 6 funds (43%) with a efficiency consistency of 60% or extra

10-year intervals; Direct Plan Funds vs Nifty Midcap 150 TRI

- 8 funds throughout all classes with not less than 500 5-year knowledge factors

- 3 funds (37%) with a efficiency consistency of 70% or extra

- 4 funds (50%) with a efficiency consistency of 60% or extra

Flexicap Funds:

5-year intervals; Direct Plan Funds vs Nifty 200 TRI

- 20 funds throughout all classes with not less than 500 5-year knowledge factors

- 9 funds (45%) with a efficiency consistency of 70% or extra

- 11 funds (55%) with a efficiency consistency of 60% or extra

10-year intervals; Direct Plan Funds vs Nifty 200 TRI

- 13 funds throughout all classes with not less than 500 5-year knowledge factors

- 7 funds (54%) with a efficiency consistency of 70% or extra

- 8 funds (61%) with a efficiency consistency of 60% or extra

Centered Funds

5-year intervals; Direct Plan Funds vs Nifty 200 TRI

- 15 funds throughout all classes with not less than 500 5-year knowledge factors

- 6 funds (40%) with a efficiency consistency of 70% or extra

- 8 funds (53%) with a efficiency consistency of 60% or extra

10-year intervals; Direct Plan Funds vs Nifty 200 TRI

- 10 funds throughout all classes with not less than 500 5-year knowledge factors

- 5 funds (50%) with a efficiency consistency of 70% or extra

- 5 funds (50%) with a efficiency consistency of 60% or extra

Extra assets:

Abstract

- “Beating” the market is just not simple!

- Solely 45% to 55% of funds persistently beat the index in most classes. Choosing these funds isn’t any assure of future outperformance.

- Buyers are higher off with passive funds: no fund supervisor danger, much less price, no efficiency nervousness, and time spent elsewhere. Ideally, a Nifty or Sensex index fund is sufficient.

- Lively funds or passive funds are usually not a major concern. We first want a correct monetary plan.

Do share this text with your mates utilizing the buttons beneath.

Get pleasure from large reductions on our programs, robo-advisory device and unique investor circle!

Get pleasure from large reductions on our programs, robo-advisory device and unique investor circle!  & be part of our group of 5000+ customers!

& be part of our group of 5000+ customers!

Use our Robo-advisory Instrument for a start-to-finish monetary plan! ⇐ Greater than 1,000 traders and advisors use this!

New Instrument! => Observe your mutual funds and inventory investments with this Google Sheet!

Podcast: Let’s Get RICH With PATTU! Each single Indian CAN develop their wealth!

You possibly can watch podcast episodes on the OfSpin Media Pals YouTube Channel.

- Do you could have a remark concerning the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Have a query? Subscribe to our e-newsletter with the shape beneath.

- Hit ‘reply’ to any electronic mail from us! We don’t provide personalised funding recommendation. We are able to write an in depth article with out mentioning your identify you probably have a generic query.

Be a part of over 32,000 readers and get free cash administration options delivered to your inbox! Subscribe to get posts through electronic mail!

Discover the location! Search amongst our 2000+ articles for data and perception!

About The Creator

Dr. M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product growth. Join with him through Twitter, Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Price-only India,” an organisation selling unbiased, commission-free funding recommendation.

Dr. M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product growth. Join with him through Twitter, Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Price-only India,” an organisation selling unbiased, commission-free funding recommendation.

Our flagship course! Be taught to handle your portfolio like a professional to realize your objectives no matter market situations! ⇐ Greater than 3,000 traders and advisors are a part of our unique group! Get readability on learn how to plan to your objectives and obtain the required corpus it doesn’t matter what the market situation is!! Watch the primary lecture totally free! One-time fee! No recurring charges! Life-long entry to movies! Cut back worry, uncertainty and doubt whereas investing! Learn to plan to your objectives earlier than and after retirement with confidence.

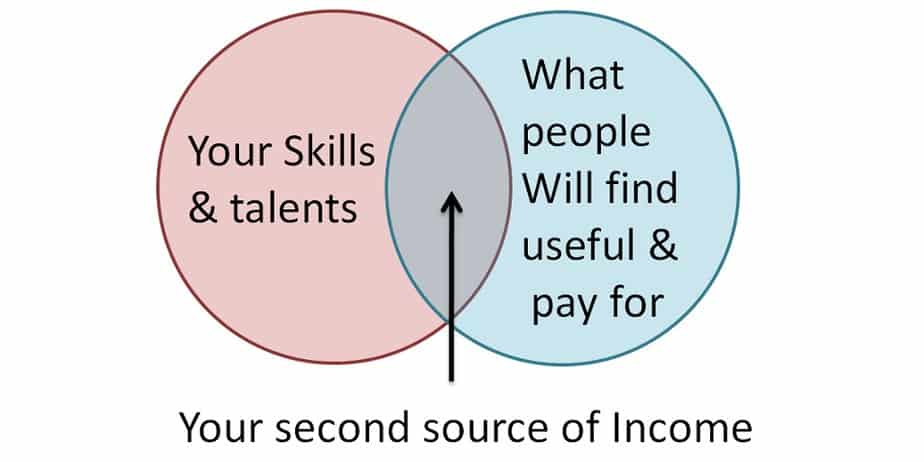

Our new course! Enhance your revenue by getting individuals to pay to your abilities! ⇐ Greater than 700 salaried staff, entrepreneurs and monetary advisors are a part of our unique group! Learn to get individuals to pay to your abilities! Whether or not you’re a skilled or small enterprise proprietor who needs extra purchasers through on-line visibility or a salaried particular person wanting a aspect revenue or passive revenue, we are going to present you learn how to obtain this by showcasing your abilities and constructing a group that trusts you and pays you! (watch 1st lecture totally free). One-time fee! No recurring charges! Life-long entry to movies!

Our new ebook for youths: “Chinchu will get a superpower!” is now accessible!

Most investor issues may be traced to a scarcity of knowledgeable decision-making. We have all made dangerous choices and cash errors once we began incomes and spent years undoing these errors. Why ought to our kids undergo the identical ache? What is that this ebook about? As mother and father, what would it not be if we needed to groom one skill in our kids that’s key not solely to cash administration and investing however to any side of life? My reply: Sound Determination Making. So on this ebook, we meet Chinchu, who’s about to show 10. What he needs for his birthday and the way his mother and father plan for it and train him a number of key concepts of decision-making and cash administration is the narrative. What readers say!

Should-read ebook even for adults! That is one thing that each dad or mum ought to train their children proper from their younger age. The significance of cash administration and resolution making primarily based on their needs and desires. Very properly written in easy phrases. – Arun.

Purchase the ebook: Chinchu will get a superpower to your baby!

Find out how to revenue from content material writing: Our new e-book is for these serious about getting aspect revenue through content material writing. It’s accessible at a 50% low cost for Rs. 500 solely!

Need to test if the market is overvalued or undervalued? Use our market valuation device (it’ll work with any index!), or get the Tactical Purchase/Promote timing device!

We publish month-to-month mutual fund screeners and momentum, low-volatility inventory screeners.

About freefincal & it is content material coverage. Freefincal is a Information Media Group devoted to offering unique evaluation, experiences, evaluations and insights on mutual funds, shares, investing, retirement and private finance developments. We achieve this with out battle of curiosity and bias. Observe us on Google Information. Freefincal serves greater than three million readers a 12 months (5 million web page views) with articles primarily based solely on factual data and detailed evaluation by its authors. All statements made will probably be verified with credible and educated sources earlier than publication. Freefincal doesn’t publish paid articles, promotions, PR, satire or opinions with out knowledge. All opinions will probably be inferences backed by verifiable, reproducible proof/knowledge. Contact data: letters {at} freefincal {dot} com (sponsored posts or paid collaborations won’t be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Aim-Primarily based Investing

Revealed by CNBC TV18, this ebook is supposed that will help you ask the appropriate questions and search the proper solutions, and because it comes with 9 on-line calculators, you can even create customized options to your way of life! Get it now.

Revealed by CNBC TV18, this ebook is supposed that will help you ask the appropriate questions and search the proper solutions, and because it comes with 9 on-line calculators, you can even create customized options to your way of life! Get it now.

Gamechanger: Neglect Startups, Be a part of Company & Nonetheless Stay the Wealthy Life You Need

This ebook is supposed for younger earners to get their fundamentals proper from day one! It would additionally provide help to journey to unique locations at a low value! Get it or reward it to a younger earner.

This ebook is supposed for younger earners to get their fundamentals proper from day one! It would additionally provide help to journey to unique locations at a low value! Get it or reward it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low-cost flights, funds lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 300 (on the spot obtain)

That is an in-depth dive evaluation into trip planning, discovering low-cost flights, funds lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 300 (on the spot obtain)

[ad_2]

The post Lively Mutual Funds Outperformance Consistency Report (March 2024) appeared first on kitko.

]]>The post Find out how to construct lifelong passive earnings appeared first on kitko.

]]>Many are drawn to the idea of producing passive earnings, but few can obtain substantial outcomes. This piece will discover the explanations behind such shortcomings and supply a passive earnings framework that may result in a constant earnings stream. Our focus can be on cultivating passive earnings on-line.

Many people wrestle to construct passive earnings: (1) Our understanding of passive earnings is proscribed. In actuality, the idea of utterly passive earnings is a fable. Merely establishing an internet or offline income with the expectation of a lifetime of earnings is unrealistic. True passive earnings solely refers to earnings streams that require minimal effort, not zero effort.

(2) Everybody desires the cash, however nobody desires to work arduous: Constructing a gentle and dependable passive earnings stream from an internet presence will take about 3-5 years. We should recurrently assist others and construct a reliable presence with out expectations throughout this time.

(3) I hate to say this, however only a few of us have one thing helpful to supply! To make folks purchase from us, we should present one thing helpful. If we don’t have this skill, then we should develop this skill. In my Earn From Expertise course, I level out that the suitable time to begin monetizing is when your readers/viewers write to you saying, “I’ll purchase no matter you’re promoting.”

(4) Recognition shouldn’t be the important thing to success! In our present society, one’s variety of subscribers, followers, or verified account standing is usually used as a metric for judging folks. Sadly, these metrics have little correlation with on-line earnings. Recognition attracts in a crowd; as a rule, crowds don’t suppose critically. Then again, attracting an viewers of clever readers or viewers will enhance the opportunity of financial achieve and result in referrals to others who admire high quality content material.

We are able to solely construct easy, low-cost merchandise for freshmen by aiming for recognition, and the competitors can be intense. A specialised on-line presence can simply earn more money with fewer followers, and the competitors can be considerably much less. You’ll be able to construct a powerful aggressive moat round your on-line presence.

A template for passive earnings

So how do you go about constructing passive earnings?

- Cease eager about the cash! Our aim ought to solely be to teach ourselves and to achieve a degree the place we may also help others. When this occurs usually, money-making alternatives will come up routinely.

- There are two prospects. You could have already got a ability or skill to resolve a particular drawback.

- For instance, you might know tips on how to arrange an e-commerce web site;

- You could know tips on how to create a monetary plan;

- You could know tips on how to shed some pounds and so forth.

- Otherwise you want to know extra a couple of specific space. Dig deep, study it and share it. For instance, once I began to make use of Excel for my monetary planning, I knew nothing about Excel or monetary planning. I studied, centered on a single drawback, solved it and moved to a better degree drawback and so forth. If I shared my learnings, it will present worth to others.

- Time administration is important! You could allocate about 4-5 hours per week to your venture.

- Begin an internet presence: tweet about developments in your ability area. Write brief articles on Fb, in a weblog, and on Youtube. Create a group; create an identification (even when folks hate your views, they shouldn’t be capable of ignore you). Polarization works!

- Develop your communities belief.

- Recognise their issues. This is able to encourage not solely new content material but additionally new merchandise.

- Don’t begin promoting something till folks write to you saying: “I need you to assist. How do I pay?”

- Recognise all this may take years and years to achieve traction.

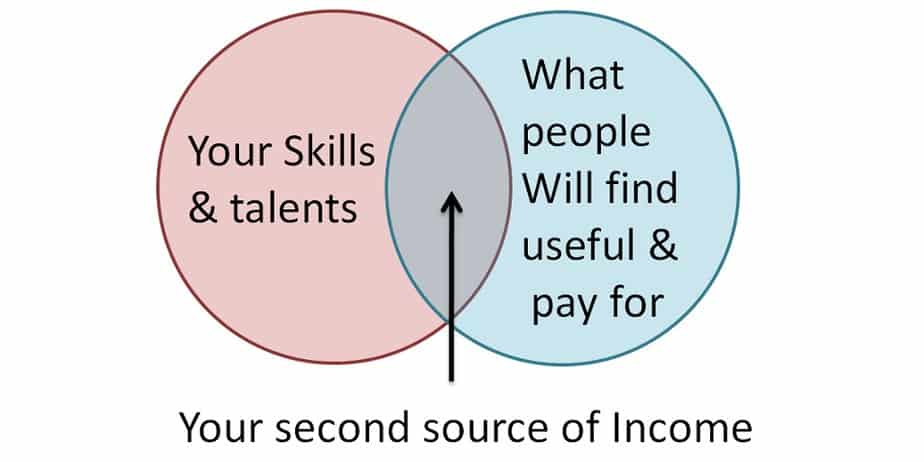

Theoretically, lively or passive earnings is the overlap of ability and utiity. Virtually it’s all about consistency

Passive earnings relies on two key components: worth and belief.

- The worth right here refers to how nicely you fulfill the necessities of your followers. A great quantity of this worth needs to be provided totally free with out holding again in order that your readers admire your experience. How else are you able to persuade them to purchase your merchandise?! Worth alone shouldn’t be sufficient.

- Belief right here means it doesn’t matter what, you’ll all the time present unbiased content material. Any sponsorships or affiliation from product producers will break this belief together with your readers/viewers.

The extra reliable worth you present, the extra members of your group can be able to pay in your merchandise. Discover that we’ve got up to now not talked about how you should create a passive earnings product! Once you supply reliable worth recurrently, product concepts will come to you!

What issues probably the most is constructing belief and providing worth recurrently: No less than as soon as every week – consistency is every little thing on this enterprise! To be constant, you must handle your time effectively!

Affected person effort – with out expectations – that helps others and subsequently teaches us to develop into higher.

That is the key of constructing a passive earnings that will final a lifetime. We have now a detailed video course overlaying all of the steps talked about above and extra that can assist you construct such an earnings.

Sricharan Monigari, an Oracle HCM cloud resolution architect, has to say the next in regards to the course:

After a yr, I began membership plans, and among the common readers signed up for it, the place I submit unique content material for them, which they can’t discover elsewhere. Together with that, I’m producing some bucks utilizing Google Adsense too. Total, if in case you have an thought in thoughts and are fighting the place to begin and tips on how to begin, this course would allow you to join the dots and get began with out procrastinating. Thanks, Pattu, for creating this course and serving to others begin the journey of aspect hustle.

Do share this text with your folks utilizing the buttons under.

Get pleasure from huge reductions on our programs, robo-advisory device and unique investor circle!

Get pleasure from huge reductions on our programs, robo-advisory device and unique investor circle!  & be a part of our group of 5000+ customers!

& be a part of our group of 5000+ customers!

Use our Robo-advisory Software for a start-to-finish monetary plan! ⇐ Greater than 1,000 traders and advisors use this!

New Software! => Observe your mutual funds and inventory investments with this Google Sheet!

Podcast: Let’s Get RICH With PATTU! Each single Indian CAN develop their wealth!

You’ll be able to watch podcast episodes on the OfSpin Media Buddies YouTube Channel.

- Do you have got a remark in regards to the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Have a query? Subscribe to our publication with the shape under.

- Hit ‘reply’ to any e mail from us! We don’t supply customized funding recommendation. We are able to write an in depth article with out mentioning your title if in case you have a generic query.

Be a part of over 32,000 readers and get free cash administration options delivered to your inbox! Subscribe to get posts through e mail!

Discover the location! Search amongst our 2000+ articles for info and perception!

About The Creator

Dr. M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him through Twitter, Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You will be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration matters. He’s a patron and co-founder of “Price-only India,” an organisation selling unbiased, commission-free funding recommendation.

Dr. M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him through Twitter, Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You will be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration matters. He’s a patron and co-founder of “Price-only India,” an organisation selling unbiased, commission-free funding recommendation.

Our flagship course! Be taught to handle your portfolio like a professional to realize your targets no matter market situations! ⇐ Greater than 3,000 traders and advisors are a part of our unique group! Get readability on tips on how to plan in your targets and obtain the required corpus it doesn’t matter what the market situation is!! Watch the primary lecture totally free! One-time fee! No recurring charges! Life-long entry to movies! Cut back worry, uncertainty and doubt whereas investing! Discover ways to plan in your targets earlier than and after retirement with confidence.

Our new course! Improve your earnings by getting folks to pay in your expertise! ⇐ Greater than 700 salaried workers, entrepreneurs and monetary advisors are a part of our unique group! Discover ways to get folks to pay in your expertise! Whether or not you’re a skilled or small enterprise proprietor who desires extra shoppers through on-line visibility or a salaried individual wanting a aspect earnings or passive earnings, we are going to present you tips on how to obtain this by showcasing your expertise and constructing a group that trusts you and pays you! (watch 1st lecture totally free). One-time fee! No recurring charges! Life-long entry to movies!

Our new e-book for youths: “Chinchu will get a superpower!” is now out there!

Most investor issues will be traced to a scarcity of knowledgeable decision-making. We have all made unhealthy choices and cash errors after we began incomes and spent years undoing these errors. Why ought to our youngsters undergo the identical ache? What is that this e-book about? As mother and father, what would it not be if we needed to groom one skill in our youngsters that’s key not solely to cash administration and investing however to any facet of life? My reply: Sound Choice Making. So on this e-book, we meet Chinchu, who’s about to show 10. What he desires for his birthday and the way his mother and father plan for it and educate him a number of key concepts of decision-making and cash administration is the narrative. What readers say!

Should-read e-book even for adults! That is one thing that each mum or dad ought to educate their children proper from their younger age. The significance of cash administration and resolution making primarily based on their desires and wishes. Very properly written in easy phrases. – Arun.

Purchase the e-book: Chinchu will get a superpower in your baby!

Find out how to revenue from content material writing: Our new e book is for these desirous about getting aspect earnings through content material writing. It’s out there at a 50% low cost for Rs. 500 solely!

Wish to test if the market is overvalued or undervalued? Use our market valuation device (it is going to work with any index!), or get the Tactical Purchase/Promote timing device!

We publish month-to-month mutual fund screeners and momentum, low-volatility inventory screeners.

About freefincal & it is content material coverage. Freefincal is a Information Media Group devoted to offering authentic evaluation, studies, evaluations and insights on mutual funds, shares, investing, retirement and private finance developments. We accomplish that with out battle of curiosity and bias. Observe us on Google Information. Freefincal serves greater than three million readers a yr (5 million web page views) with articles primarily based solely on factual info and detailed evaluation by its authors. All statements made can be verified with credible and educated sources earlier than publication. Freefincal doesn’t publish paid articles, promotions, PR, satire or opinions with out information. All opinions can be inferences backed by verifiable, reproducible proof/information. Contact info: letters {at} freefincal {dot} com (sponsored posts or paid collaborations is not going to be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Purpose-Primarily based Investing

Revealed by CNBC TV18, this e-book is supposed that can assist you ask the suitable questions and search the proper solutions, and because it comes with 9 on-line calculators, you too can create customized options in your life-style! Get it now.

Revealed by CNBC TV18, this e-book is supposed that can assist you ask the suitable questions and search the proper solutions, and because it comes with 9 on-line calculators, you too can create customized options in your life-style! Get it now.

Gamechanger: Overlook Startups, Be a part of Company & Nonetheless Dwell the Wealthy Life You Need

This e-book is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally allow you to journey to unique locations at a low price! Get it or present it to a younger earner.

This e-book is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally allow you to journey to unique locations at a low price! Get it or present it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low cost flights, price range lodging, what to do when travelling, and the way travelling slowly is healthier financially and psychologically, with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (instantaneous obtain)